An inventory costing method is simply the way your business calculates the value of the products it sells and the products it still has on hand. Think of it as the rulebook for assigning a dollar value to your inventory.

This becomes really important when the price you pay for the same item changes over time. That fluctuation is where things get tricky, and the method you choose directly affects your company's profit, how much you owe in taxes, and the overall financial picture you present on your balance sheet.

Why Your Inventory Costing Method Matters

Let's imagine you own a small coffee shop. In January, you buy a batch of premium coffee beans for $10 per pound. By March, a supply chain hiccup causes the price to jump to $12 per pound for the exact same beans.

When a customer walks in and buys a bag, which cost do you assign to that sale? Do you use the older $10 cost or the newer $12 cost? Your answer depends entirely on your inventory costing method.

This isn't just some fussy accounting detail; it's a strategic decision that sends ripples through your financial statements.

The Core of the Problem

At its heart, inventory costing tackles a simple but critical challenge: how to put a monetary value on the items that leave your shelves (your Cost of Goods Sold, or COGS) and the items that are left behind. Without a consistent system, your financial reports would be a mess. This is why accountants rely on standardized methods to keep things accurate and comparable.

The method you choose has a major say in your financial reporting and tax obligations. The three most common methods—FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and Weighted Average Cost—all work differently.

For instance, FIFO assumes you sell your oldest inventory first. This keeps your ending inventory value aligned with the most recent costs, which is a more accurate reflection of current market prices. This is a huge plus for businesses with perishable goods, like a bakery. Using FIFO, the bakery can match its flour and sugar costs more precisely to its production schedule, ensuring its financial reports mirror the latest price changes. You can learn more from inventory experts about how these methods influence financial reporting.

Key Impacts on Your Business

Your choice here directly influences a few key areas of your business:

- Profitability Reporting: When prices are on the rise, a method like FIFO can make your business look more profitable on paper. In the same scenario, LIFO would show lower profits.

- Tax Obligations: Because your reported profit changes, so does your taxable income. During inflationary periods, LIFO can sometimes lead to a lower tax bill.

- Balance Sheet Health: The value of your remaining inventory is a major asset on your balance sheet. Each method will give you a different inventory valuation, which affects your company’s perceived net worth.

For a deeper dive into the different ways to value your stock, check out this excellent guide on understanding various inventory valuation methods.

Now, let's break down the main players—FIFO, LIFO, and Weighted Average—to see how each one actually works.

The Four Main Inventory Costing Methods Explained

Choosing an inventory costing method is a lot like picking a lane on the highway. Each one moves at a different speed and gives you a different view of your business's financial landscape. They all get you to the same destination—an accurate valuation—but the journey can look very different.

Let's unpack the four main methods. Each one has its own logic for assigning costs, making them better suited for different kinds of businesses, products, and even financial strategies. Getting a feel for how they work is the first step to choosing the right one for you.

FIFO: The First-In, First-Out Method

Think about the milk aisle at your local grocery store. The stocker always puts the newest cartons at the back, pushing the older ones to the front. This simple act ensures the first cartons to arrive are the first ones a customer buys. That’s the First-In, First-Out (FIFO) method in a nutshell.

FIFO runs on a straightforward assumption: the first inventory you buy is the first inventory you sell. So, when you ring up a sale, you match it with the cost of your oldest stock.

This approach just makes sense for businesses dealing with perishable goods like food, or anything with a short shelf life, like fashion or certain electronics. It’s a practical way to prevent products from expiring or going out of style on your shelves, which is a direct hit to your profit.

Key Advantages of FIFO:

- Logical Flow: It mirrors the natural, physical movement of goods for most businesses, making it incredibly easy to understand and manage.

- Accurate Inventory Valuation: Your remaining inventory—the assets on your balance sheet—is valued at the most recent purchase prices, which gives you a more accurate reflection of current market value.

- Higher Reported Profits: When prices are rising (inflation), FIFO matches older, lower costs against today’s higher sales prices. This results in a higher reported gross profit on your income statement.

All in all, FIFO tends to paint a clear, and often rosier, picture of your company's financial health, which can be a real plus when you’re talking to investors or lenders.

LIFO: The Last-In, First-Out Method

Now, picture a big pile of gravel or a stack of firewood. You almost always grab from the top of the pile first—the last thing you added is the first thing you take away. This is the simple idea behind the Last-In, First-Out (LIFO) method.

LIFO assumes that the most recently purchased inventory is the first to be sold. When you make a sale, you assign it the cost of your newest stock, leaving the older (and often cheaper) inventory sitting on your books.

This method is really only used for non-perishable goods where the physical flow doesn't matter, like building materials or commodity metals. The appeal here is purely financial, not operational.

During inflationary periods, LIFO can offer significant tax advantages. By matching the most recent, higher costs against revenue, it reduces your reported profit, which in turn lowers your taxable income.

It’s a powerful tool, but there’s a catch. LIFO isn’t permitted under International Financial Reporting Standards (IFRS), which means its use is mostly limited to businesses operating under U.S. GAAP.

Weighted Average Cost: The Blended Approach

What happens when tracking individual costs is just not practical? Think of a gas station's huge underground storage tank. New fuel deliveries get mixed right in with the old, making it impossible to tell one batch from another. This is where the Weighted Average Cost (WAC) method comes in handy.

The WAC method simplifies everything by blending all your inventory costs into a single average. You just divide the total cost of all the goods you have for sale by the total number of units. Easy as that.

This calculation gives you one consistent, averaged cost that you apply to every single unit you sell. It smooths out the peaks and valleys of price fluctuations, giving you a stable, predictable inventory valuation. It’s the perfect fit for businesses selling large volumes of identical items where tracking each one would be a logistical nightmare.

The beauty of WAC is its simplicity. It cuts down on complex record-keeping and offers a balanced, middle-of-the-road view of your costs over time.

Specific Identification: The Precision Method

Finally, let’s step into an art gallery selling unique paintings or a car dealership with a lot full of distinct vehicles. Each item is one-of-a-kind, and each has a very specific cost tied to it. This scenario is tailor-made for the Specific Identification method.

This is by far the most precise way to track inventory, but it’s also the most work. It means tracking the exact cost of every single item from the moment you buy it to the moment you sell it. When an item sells, its specific, individual cost is moved to the Cost of Goods Sold.

This method is really only practical for businesses that deal in a small number of high-value, unique items. Think about things like:

- Custom jewelry

- Luxury cars

- Real estate properties

- Commissioned artwork

For these kinds of businesses, accuracy is everything. An averaged cost just wouldn’t cut it; it would completely distort the true profitability of selling a high-ticket item. While this method gives you unmatched precision, it simply isn’t feasible for most retailers or restaurants handling large quantities of interchangeable products. Knowing how to price these unique items is another critical piece of the puzzle, and you can learn more by mastering menu engineering and its principles for boosting profitability.

How Each Method Impacts Your Financial Reports

Understanding the theory behind inventory costing is one thing, but seeing how these methods actually affect your bottom line is where things get interesting. Your choice isn't just an accounting checkbox; it's a strategic decision that directly shapes your financial reports, influencing everything from the profits you report to the taxes you owe.

To make this real, let's follow a hypothetical business, "The Gadget Spot," as it deals with rising costs for its most popular product, the "Smart Widget." This simple scenario will show just how dramatically your financial story can change based on the method you pick.

The Scenario: A Hypothetical Business

Imagine The Gadget Spot made three separate purchases of Smart Widgets during the month, with prices climbing each time:

- Purchase 1: 100 units at $10 each

- Purchase 2: 100 units at $12 each

- Purchase 3: 100 units at $15 each

By the end of the month, they've sold a total of 250 units. Now, let's see how the numbers crunch using FIFO, LIFO, and the Weighted Average methods.

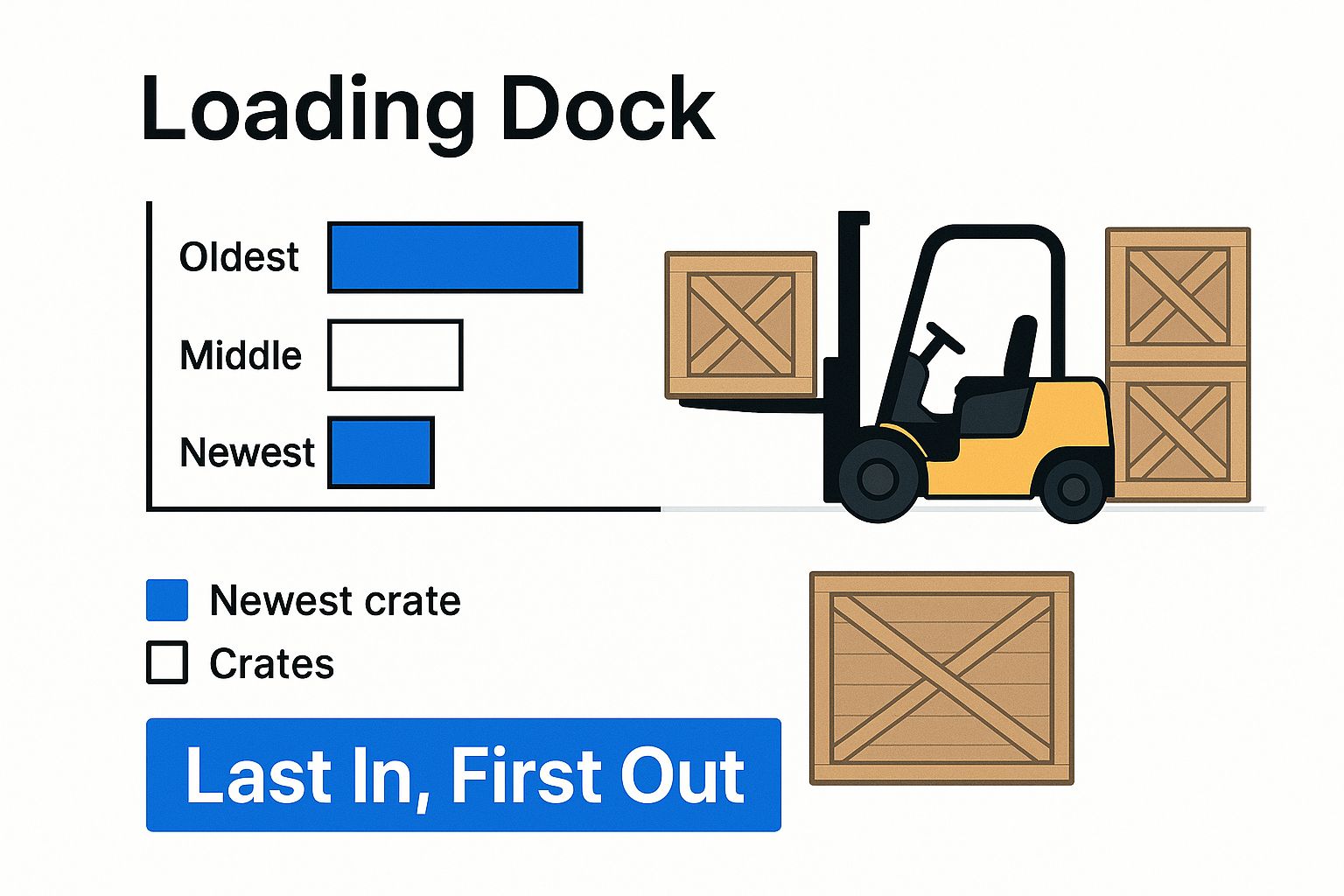

The forklift in this image places the newest crate at the front, visually representing the LIFO concept of using the most recently acquired inventory first.

This visual reinforces how LIFO prioritizes the latest costs, which has a significant impact on financial reporting during periods of changing prices.

Comparing the Financial Outcomes

The choice of inventory costing method creates significant differences in key financial metrics. Let's break down the results for The Gadget Spot in a clear comparison table.

Financial Impact of Inventory Costing Methods

This table shows how the choice of inventory costing method affects key financial metrics for a business during a period of rising prices.

| Metric | FIFO Method | LIFO Method | Weighted Average Method |

|---|---|---|---|

| Cost of Goods Sold (COGS) | $2,800 | $3,450 | $3,083 |

| Gross Profit (at $20/unit sale price) | $2,200 | $1,550 | $1,917 |

| Ending Inventory Value | $750 | $250 | $617 |

As you can see, there isn't one single "correct" number. The right answer depends entirely on the inventory costing method you choose, and each one tells a different but equally valid story about your business's performance.

The Story Behind the Numbers

So, why are these results so different? It all comes down to which costs get counted first when prices are on the rise.

-

FIFO’s Strong Balance Sheet: With FIFO, you expense the oldest, cheapest inventory first. This means your newest, most expensive items remain on the balance sheet. The result? A higher ending inventory value ($750), making your assets look stronger to lenders and investors. It also produces the highest gross profit ($2,200).

-

LIFO’s Tax Advantage: LIFO does the exact opposite. It matches your most recent—and in this case, highest—costs against your revenue. This leads to the highest COGS ($3,450) and, as a result, the lowest gross profit ($1,550). Lower profit might not sound great, but it also means a lower taxable income, which can be a huge advantage for tax planning. The trade-off is that it leaves your balance sheet with undervalued inventory.

-

Weighted Average’s Stability: This method smooths everything out. By calculating an average cost for all your inventory, it provides a middle-ground approach for COGS, gross profit, and ending inventory value. This method avoids the extreme highs and lows of FIFO and LIFO, offering a more stable and predictable financial picture over time.

Key Takeaway: Your choice is a trade-off. FIFO often presents a healthier-looking financial position for borrowing or attracting investment, while LIFO can offer immediate tax benefits during inflation. The Weighted Average method offers a balanced compromise between the two extremes.

Ultimately, understanding these impacts is crucial for smart financial management. It allows you to align your accounting practices with your business goals—whether that's maximizing reported profits, minimizing your tax burden, or simply achieving a stable outlook. Pairing this knowledge with smart operational strategies is key; for more practical tips, you might want to check out our guide on how to increase restaurant sales.

A Brief History of Inventory Tracking

To really get why today's inventory costing methods are so powerful, it helps to look back at how we got here. The journey from dusty ledgers to real-time, automated systems wasn't just about new gadgets; it was a direct response to businesses getting more and more complex. It all started with a simple problem: knowing what you have on hand and how much it's worth.

Before computers and spreadsheets, shopkeepers relied on handwritten logs and tedious physical counts. Every single item was tracked with a quill and ink, a process that was not only incredibly slow but also wide open to human error. Getting a clear picture of your business's financial health in real-time? Forget about it.

The Dawn of Automation

The real game-changer arrived in the mid-20th century with the first computers. Suddenly, the mind-numbing work of manual tracking could be handed off to a machine. These early systems were clunky and expensive, but they represented a massive leap forward, allowing businesses to crunch inventory data with unprecedented speed and accuracy.

This wave of innovation was marked by a few key milestones:

- The Punch Card Era: The first step away from pure pen-and-paper bookkeeping came from mechanical devices that used punch cards to record every transaction.

- Mainframe Computing: By the 1950s, massive mainframe computers took over, enabling far more complex inventory management and updating records faster than anyone thought possible.

- The Barcode Revolution: The universal adoption of the barcode and scanner in the 1970s and 80s changed everything. It slashed data entry time, cut down on errors, and made it practical to track an item from the moment it arrived to the moment it was sold.

These developments laid the groundwork for the systems we use today. To see just how far we've come, you can even explore things like using RFID tags for modern inventory control.

The Cloud and Modern POS Systems

The most recent and profound shift happened in the 2000s with the rise of the internet and cloud computing. This new technology leveled the playing field, giving small businesses access to powerful tools once reserved for giant corporations. Cloud-based POS and Enterprise Resource Planning (ERP) systems completely rewrote the rules.

Today’s systems provide scalable, affordable, and easily accessible platforms that connect sales, purchasing, and accounting in real time. This integration is what makes applying a consistent inventory costing method not just possible, but effortless.

From mechanical punch cards at the turn of the century to the computerized systems of the 1950s and the cloud-based platforms of the 2000s, the evolution has been staggering. This history isn't just a tech timeline; it's the story of solving a fundamental business problem, step by step, to achieve the kind of financial precision that any business can now access.

So, Which Method Is Best for Your Business?

Choosing an inventory costing method isn’t about picking the universally "best" one. It’s about finding the one that truly fits your business—your products, your industry, and your financial strategy. Think of it less like a test with a single right answer and more like getting fitted for a suit. The right choice depends entirely on your specific measurements.

To figure this out, you need to ask some honest questions about how your business operates. The answers will point you toward the method that makes the most sense for both your day-to-day operations and your long-term goals.

First, Look at Your Operations

Before diving into the numbers, let's look at the physical reality of your business. How your inventory moves and what you sell are the biggest clues.

Here’s what to consider:

- What are you selling? This is the most important question. If you’re dealing with anything perishable—like fresh food, flowers, or dairy—FIFO is the only logical choice. You naturally want to sell the oldest stuff first. But if your products don't expire, like hardware, electronics, or lumber, then LIFO or Weighted Average are back on the table.

- Are your costs all over the place? If your purchase prices swing up and down, the Weighted Average Cost method can be a lifesaver. It smooths out those volatile price changes, giving you a more predictable Cost of Goods Sold. If your costs are pretty steady, the difference between methods will be much less dramatic.

- How quickly do you sell through your inventory? Businesses with high turnover, like a busy cafe or a popular retail store, often find FIFO is the most natural fit. A good restaurant inventory management system can give you crystal-clear data on your turnover rates to help you make this call.

Aligning Your Method with Financial and Tax Goals

Your choice has a real impact on your bottom line, influencing everything from your tax bill to how attractive your business looks to investors.

Think about these financial factors:

- Want to lower your tax bill? In times of rising prices (inflation), LIFO can be a smart tax strategy. By matching your most recent, higher costs against your revenue, you report lower profits and, therefore, owe less in taxes. The trade-off? Your books will show lower net income.

- Need to impress investors or lenders? If you’re trying to paint the strongest financial picture, FIFO is usually your best bet during inflation. It produces a lower COGS and a higher gross profit. This makes your balance sheet look healthier because your remaining inventory is valued at its most recent, higher cost.

- What are the rules you have to follow? This one isn’t up for debate. While LIFO is allowed under U.S. GAAP, it’s banned by International Financial Reporting Standards (IFRS). If you do business internationally or have plans to expand, you can’t use LIFO. End of story.

The Bottom Line: Think of your inventory method as a strategic tool. FIFO can make your balance sheet shine for investors. LIFO can provide a tax shield during inflation. And the Weighted Average method offers a balanced, stable approach for businesses that just want consistency without the headaches of price swings.

By weighing these operational realities against your financial goals, you can choose the method that doesn't just work on paper but actively helps drive your business forward.

Bringing Costing Methods to Life in Your POS System

Okay, so we've covered the theory. But knowing the difference between FIFO and LIFO is one thing; actually using that knowledge to run your business is another. This is where a modern point-of-sale system like Biyo POS steps in to connect the dots between accounting theory and your day-to-day operations. The right tech handles all the complicated math for you, giving you a clear picture of your finances as they happen.

Getting started is usually pretty simple. You’ll just dive into your POS settings and pick your default inventory costing method—whether that’s FIFO, LIFO, or Weighted Average. Once you’ve set it, the system runs on autopilot. It applies that rule every single time you log a new shipment or ring up a sale, which means no more manual spreadsheets and far fewer chances for human error to creep in.

How It Works Day-to-Day

From that moment on, every single transaction is automatically logged and calculated. When a new batch of inventory arrives, you’ll enter how many units you received and what you paid for them. When you sell one of those items, the POS instantly figures out the Cost of Goods Sold (COGS) using the method you chose. This automation is key to keeping your financial data consistent and accurate.

For instance, a good inventory dashboard will show you exactly how these costs are being calculated as stock moves in and out.

This kind of visibility is huge. You can see precisely how your chosen method affects your inventory value and COGS, not just at the end of the month, but every single day.

Getting the Financial Reports You Actually Need

The real magic of setting this up in your POS is the reports you get out of it. These aren’t just spreadsheets full of numbers; they're clear insights that help you make smarter decisions. Your POS does all the heavy lifting, turning raw sales and purchasing data into a story you can actually understand.

You can pull up essential reports in just a few clicks:

- Inventory Valuation Report: This tells you the exact dollar value of the inventory you currently have on hand, calculated based on your costing method. This number is a critical asset on your balance sheet.

- Cost of Goods Sold (COGS) Analysis: This report breaks down the direct costs of the products you sold over a certain time, giving you a crystal-clear look at your expenses.

- Profitability Reports: By automatically subtracting the COGS from your sales revenue, these reports give you a real-time, accurate picture of your gross profit margins—by item, by category, or across the entire business.

When you use your POS to manage inventory costing, you’re turning an abstract accounting choice into a powerful, practical tool for managing your business. It makes sure every sale and purchase is accounted for correctly, empowering you to make decisions based on real data that directly affects your bottom line.

Frequently Asked Questions

It's natural to have questions when you're wading into inventory costing. Let's tackle some of the most common ones to clear things up and help you move forward with confidence.

Can I Change My Inventory Costing Method?

Yes, but it's a big deal. Switching your inventory costing method isn't something you can do on a whim; it's a major accounting change that has ripple effects across your financial reporting.

In the U.S., for instance, you can't just flip-flop between methods to make your profits look better. You'll typically need to file Form 3115 with the IRS and justify the switch with a solid business reason. Accountants live by the principle of consistency, so regulators want to see that a real operational or financial shift prompted the change.

The bottom line? While you can change methods, it involves formal processes and careful planning. It's far easier to choose the right method from the get-go.

Changing methods also makes it harder to compare your financial performance year-over-year, so it’s a move you’ll definitely want to discuss with your accountant first.

Which Inventory Costing Method Is Most Common?

Hands down, FIFO (First-In, First-Out) is the most popular method out there. It’s the go-to for most businesses, especially if you’re selling anything perishable or trend-driven, like food, fashion, or electronics.

The logic just makes sense—sell the oldest stuff first. This mirrors the natural, physical flow of inventory for most retailers, restaurants, and grocers. Plus, it's accepted under both U.S. GAAP and the international IFRS standards, which makes it a safe bet for global compliance. While LIFO offers some tax perks during inflationary times, its complexity and restrictions mean it’s not nearly as common.

Does My Business Size Matter When Choosing a Method?

It certainly does. The Specific Identification method, for example, really only works for businesses selling unique, high-ticket items. Think art galleries, custom jewelers, or specialty car dealers. Trying to track every single item would be a nightmare for a busy retail shop.

For most small and medium-sized businesses, the real decision is between FIFO, LIFO, and Weighted Average.

- FIFO: A fantastic choice for its simplicity and how well it matches the real-world flow of goods.

- Weighted Average: Great for businesses where individual products get mixed together (like grains or liquids) or for anyone who wants to smooth out cost fluctuations without a ton of tracking.

While a huge corporation might use LIFO for strategic tax planning, smaller businesses usually find the straightforward nature of FIFO or Weighted Average to be a much bigger win.

How Do I Know if I Made the Right Choice?

You'll know you picked the right inventory costing method when it clicks with three things: how your business actually operates, your financial strategy, and your legal requirements.

The right method will produce financial reports that feel true to your industry. Your inventory value on the books will seem accurate, not wildly inflated or understated. And most importantly, your accounting process will be manageable, not a constant headache. If you're only reconsidering your choice because of a major change—like a new business model, dramatic supply chain shifts, or international expansion—you probably made the right call from the start.

Ready to stop guessing and start managing your inventory with precision? Biyo POS makes it simple to set up your costing method, automate the math, and see exactly where your money is going in real-time.

Discover how our all-in-one system can support your business by visiting https://biyopos.com and starting your free trial today.