So, what exactly is an offline credit card transaction?

Think of it as a payment that's temporarily saved on your point-of-sale (POS) device when there’s no internet. The whole process is often called Store and Forward, and it’s a lifesaver. It lets you keep making sales during a network outage and simply process everything once you're back online.

Understanding Offline Transactions

Picture this: it's the morning rush at your coffee shop, the line is out the door, and suddenly, your internet dies. Normally, that would stop your business in its tracks. No internet, no card payments.

This is where offline transactions come in. They act as a crucial safety net. Instead of rejecting a customer's card, your POS system essentially gives a temporary thumbs-up, trusting that the bank will approve it later.

The terminal securely captures the customer's card information without immediately checking with the card issuer. You can hand over that latte, serve the next person, and keep the line moving. For any business that can't afford to stop selling, it's a must-have feature.

How It Works: The Basics

The magic behind it all is a simple but powerful concept. When your system loses its connection, it switches into "store and forward" mode. Here's a quick breakdown of what that means for your daily operations:

- Store: The POS terminal encrypts the transaction details and stores them securely right there on the device. It's not just a quick note—it's a locked-down data packet, ready and waiting.

- Forward: As soon as your internet is back, the POS system automatically sends this saved batch of transactions to the payment processor to get the official authorization and settlement.

This feature is a game-changer for businesses in places with spotty Wi-Fi or for anyone on the move. To get the full picture, it helps to understand the fundamentals of payment processing in general.

An offline transaction ensures business continuity. It turns a potential lost sale into a completed one, protecting your revenue and keeping customers happy even when technology lets you down.

In short, you're accepting a payment with the faith that it will be approved later. It does come with a small, calculated risk, but the benefit of never having to turn a customer away is huge. For vendors at outdoor markets, food trucks, or even regular retail stores hit by an outage, this isn't just a nice-to-have feature—it's a lifeline.

From Carbon Copies to Encrypted Chips

To really get why today's offline payment tech is so secure and slick, it helps to look back at how far we've come. The leap from those clunky old mechanical machines to the smart little computers in our wallets today is a story all about payment security.

Not so long ago, the original offline credit card transaction was a totally physical affair. Merchants would grab a mechanical imprinter—you might know it as a "zip-zap" machine—and physically press the customer's card details onto a carbon-copy slip. It was clunky, slow, and a huge magnet for fraud.

Think about it: those paper slips had the customer's full card number and expiration date right there in plain sight. This old-school method was built entirely on trust and a bit of manual checking, a world away from the secure systems we rely on now.

The Dawn of Digital Data

The arrival of the magnetic stripe back in the 1960s felt like a major upgrade. It definitely sped up live, in-person transactions, but for offline security? It didn't move the needle much. The data on a magstripe was static and frighteningly easy to clone, leaving businesses wide open to risk if they couldn't get a live connection.

The real game-changer was the worldwide shift to EMV (Europay, Mastercard, and Visa) chip technology. This wasn't just a new way to read a card; it completely rewrote the rules for transaction security, especially when you were offline.

The EMV chip put a powerful microcomputer right inside every credit and debit card. This little chip generates unique, encrypted data for every single sale, making it almost impossible for thieves to clone cards or cook up fake transactions.

This whole evolution is tied to the global rollout of chip cards, which started picking up steam in the mid-1990s. Before this standard became common, offline approvals had to rely on that insecure magnetic stripe data. The EMV chip changed everything by enabling secure offline data authentication and PIN verification, giving terminals the confidence to approve smaller transactions on their own, no immediate phone call to the bank required.

The Modern Standard of Security

The chip's ability to run complex security checks without needing an internet connection is what makes modern offline transactions a reality. It can confirm a card is legit and check against pre-set risk limits all by itself. This is what lets us pay securely everywhere, from 30,000 feet up in an airplane to a stall at the local farmer's market.

This built-in smarts also set the stage for even more advanced security. Many of the same principles are now at the heart of digital payment systems through a process called tokenisation, which adds another layer of protection for sensitive card details.

Thanks to this long road of innovation, what started as a risky, paper-shuffling task is now a secure and incredibly useful feature. The encrypted chip has turned the offline credit card transaction into a dependable tool for businesses everywhere.

How Store and Forward Payments Actually Work

So, what really happens when you accept a credit card payment without an internet connection? Let's walk through the journey of an offline credit card transaction, from the moment a customer hands you their card to the money landing in your account. The whole thing is a surprisingly elegant, automated dance designed to keep sales flowing, even when the Wi-Fi isn't.

It all starts right at your point of sale. When a customer taps or dips their card, your offline-enabled terminal has a quick, direct chat with the card's EMV chip. This chip is more than just a memory stick; it's a tiny, secure computer. It runs its own on-the-spot risk assessment, confirming the card is legit and checking against its own internal rules, like pre-set spending limits for offline transactions.

The Journey of an Offline Transaction

If the card's chip gives the initial thumbs-up, the transaction gets a temporary green light. Your POS system then encrypts all the critical payment details and squirrels them away safely in its local storage. This isn’t like scribbling a credit card number on a notepad—it’s a highly secure, encrypted data packet held in limbo until your internet comes back online.

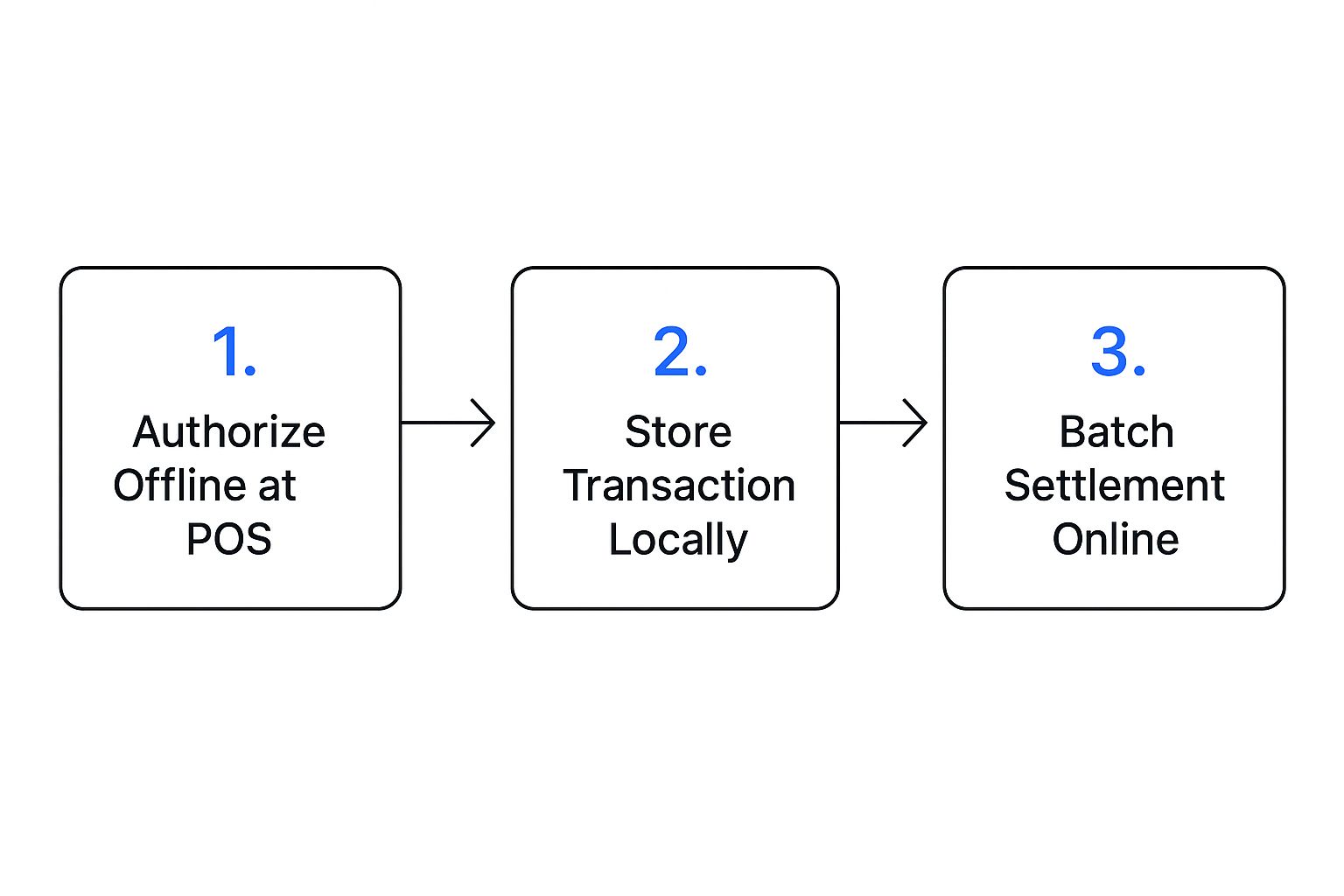

This infographic lays out the three main stages of the process.

As you can see, the magic happens in those first two steps. The POS handles the initial authorization and local storage completely offline, so you never miss a sale just because your connection dropped.

The moment your internet is back, the "forward" part of the sequence begins automatically. You don't have to lift a finger. The POS system simply bundles up all the transactions it has been holding onto and sends them off in a single batch to your payment processor.

At its heart, the store and forward method is about capturing payment information now and seeking official bank authorization later. The EMV chip provides the initial layer of security, while the POS system manages the secure storage and subsequent forwarding of the data.

From Processor to Your Bank Account

Once the payment processor receives the batch of transactions, it gets to work. It sends each payment through the correct card networks (think Visa or Mastercard) to the customer's bank for the final, official approval. It's the digital version of taking a stack of credit card slips to the bank at the end of the day.

After the banks give their final okay, the funds are transferred and deposited right into your merchant account. The journey is complete. For businesses like cafes and pop-up shops, this reliability is a game-changer. You can find out more about what to look for in the best affordable tablet POS for small cafes with offline mode to see how it works in the real world.

If you want to dig deeper into the mechanics of how these payments are sent and finalized, understanding payment gateway integration can shed a lot of light on the process. This is the crucial online step that makes sure you get paid for every sale you made while disconnected.

Weighing the Rewards and Risks of Offline Payments

Deciding to accept an offline credit card transaction is all about balancing the reward of never missing a sale against the very real risk of that payment failing later. For a lot of businesses, being able to keep the registers ringing without a live internet connection isn't a luxury—it's a lifeline.

The biggest win here is business continuity. Think about a busy cafe when a storm suddenly knocks out the Wi-Fi. With offline mode, customers can still pay and go, meaning you don’t lose out on all that revenue and everyone stays happy. This is a game-changer for pop-up shops, food trucks, and anyone set up in a place with spotty internet.

Of course, there’s a catch. Because the transaction isn’t approved on the spot, there's a higher chance it could get declined once it finally reaches the bank. The reason could be anything from insufficient funds to a stolen card.

Offline Transactions: A Risk vs. Reward Analysis

To make an informed decision, it helps to see the pros and cons laid out side-by-side. On one hand, you have the potential for seamless operations and happy customers; on the other, you have the financial risk of failed payments.

| Benefits of Offline Mode | Risks of Offline Mode |

|---|---|

| Never Miss a Sale: Keep operating and accepting payments even when the internet is down. | Declined Payments: Transactions can fail later due to insufficient funds or invalid cards. |

| Faster Checkout: Lines keep moving during peak times, preventing customer frustration. | Financial Loss: A failed payment means you lose the sale amount and the product/service. |

| Increased Revenue: Every sale saved during an outage directly protects your bottom line. | Chargeback Exposure: The risk of chargebacks from fraudulent or disputed transactions is higher. |

| Customer Loyalty: A reliable payment process, rain or shine, builds trust with your clientele. | Delayed Cash Flow: You won't receive the funds until the transactions are processed online. |

Ultimately, it comes down to your business's specific needs and risk tolerance. For a high-volume coffee shop, the small risk of a few declined payments is often worth the reward of keeping the morning rush moving.

The Upsides of Staying Open

The benefits of offline payments directly impact your customer experience and, most importantly, your revenue. When your system just works, regardless of connectivity, you build a reputation for reliability.

The key advantages really boil down to this:

- Zero Downtime: You can take payments anytime, anywhere, which means no more lost sales from technical hiccups.

- Improved Customer Flow: Keeping lines moving prevents walkouts and keeps the energy positive during busy periods.

- Increased Revenue: Every transaction you save from an internet outage is money in the bank.

This capability is a core reason why modern POS systems are so valuable. They allow you to process payments without immediate bank authorization, which is incredibly useful when things go offline. If you want to dive deeper, you can find more insights about the credit card payment market and its complexities.

Understanding the Potential Downsides

The main risk is straightforward: a transaction gets declined long after the customer has walked away with their purchase. This means you’re out the cost of the goods or services, a situation that leads to a chargeback or a complete loss on that sale.

A payment can fail for a few common reasons:

- Insufficient Funds: The customer simply didn't have enough money in their account.

- Expired or Invalid Card: The card was expired, canceled, or even reported stolen.

- Fraud Alerts: The bank's security system might flag the purchase as unusual and block it.

Every business owner has to ask themselves a simple question: Does the reward of never missing a sale outweigh the potential loss from a handful of declined transactions?

For most businesses with a high volume of smaller-ticket items, the answer is usually a clear "yes." By understanding both the undeniable benefits and the risks involved, you can make a smart, calculated decision that helps protect and grow your business.

Best Practices for Managing Offline Transactions

You can't completely eliminate the risks that come with offline credit card transactions, but you can definitely manage them with a few smart strategies. It’s all about creating clear policies that protect your revenue and ensure this feature acts as a safety net, not a financial liability. This starts with setting firm boundaries and training your team to stick to them.

The most effective line of defense is setting a floor limit. This is simply the maximum dollar amount you’re willing to risk on a single offline payment. By keeping this limit conservative, you put a hard cap on your potential loss if that card is ultimately declined.

Think about it: a coffee shop might set its floor limit at $50. They know most of their orders are well under that, so this simple setting in their POS system prevents one large, risky transaction from causing a major financial headache.

Establishing Clear Operational Rules

Beyond just setting a dollar limit, your day-to-day habits are crucial for keeping risks low. The goal is to build a consistent process for your staff to follow, especially when the pressure is on during a network outage. A well-trained team is your best asset here.

Here are a few essential practices to put in place:

- Process Immediately: The number one rule is to process all your stored transactions the second your internet comes back online. The longer they sit, the higher the chance they’ll be declined.

- Train Your Team: Make sure your staff knows your offline policies inside and out, including the floor limit. They need to understand the risks and the exact procedure for taking payments when the system is offline.

- Configure Automatic Sync: Set up your POS terminal to automatically sync the moment it reconnects. This takes human error out of the equation and gets the authorization process rolling much faster.

Think of stored offline payments like perishable goods. The longer they sit on the shelf, the more likely they are to "spoil." Processing them quickly is the key to making sure you actually get paid for the sales you made.

Choosing the Right Technology

Ultimately, your best defense is a modern POS system built with solid offline capabilities. These systems automate many of the safeguards we've talked about, from enforcing floor limits to handling the sync process without anyone having to lift a finger.

Good systems also give you detailed reports, letting you track offline sales and spot any potential issues right away. Remember, managing payment data requires strict security. Getting a handle on the basics of PCI compliance is non-negotiable for any business taking card payments. By combining smart policies with the right tech, you can use offline mode confidently to keep your business running, no matter what.

Got Questions About Offline Payments? We’ve Got Answers.

Even after getting the hang of the process, it's natural to have a few practical questions about handling offline credit card transactions. Let's tackle some of the most common ones head-on.

What Happens if an Offline Credit Card Transaction Is Declined Later?

This is the big one. If an offline transaction gets declined once you’re back online, the merchant unfortunately takes the hit. Since the sale went through without a live thumbs-up from the bank, those funds will never make it to your account.

That's the core risk of offline mode, and it’s exactly why setting smart limits and following best practices is so important. It's all about protecting your business from taking a significant financial loss.

Can I Accept Debit Cards for Offline Transactions?

Generally, no. Most debit cards that require a PIN for verification won't work offline. The reason is simple: that PIN needs an active connection to the customer's bank to confirm it's correct.

The exception? Some debit cards are co-branded with Visa or Mastercard and can be processed as "credit" without a PIN. Whether these go through depends entirely on the rules set by both the card issuer and your payment processor.

Don't wait around! It's absolutely critical to process stored transactions as soon as you're back online, ideally within 24 hours. Most processors set a hard deadline, often around 7 days, after which they might reject the transaction completely.

How Long Can a Merchant Store an Offline Transaction?

Your POS system might be able to hold onto a transaction for several days, but letting it sit is a gamble. The golden rule is to upload and process these stored payments the moment your internet is back up and running.

Processing them quickly drastically cuts down the risk of a decline, which can happen if a customer's account balance changes or the card gets reported lost. This helps you get paid faster and keeps your cash flow steady and predictable.

Ready to arm your business with a POS that never lets a sale slip away, even when the internet does? See how Biyo POS can keep you running smoothly, no matter what. Start your 14-day free trial today!