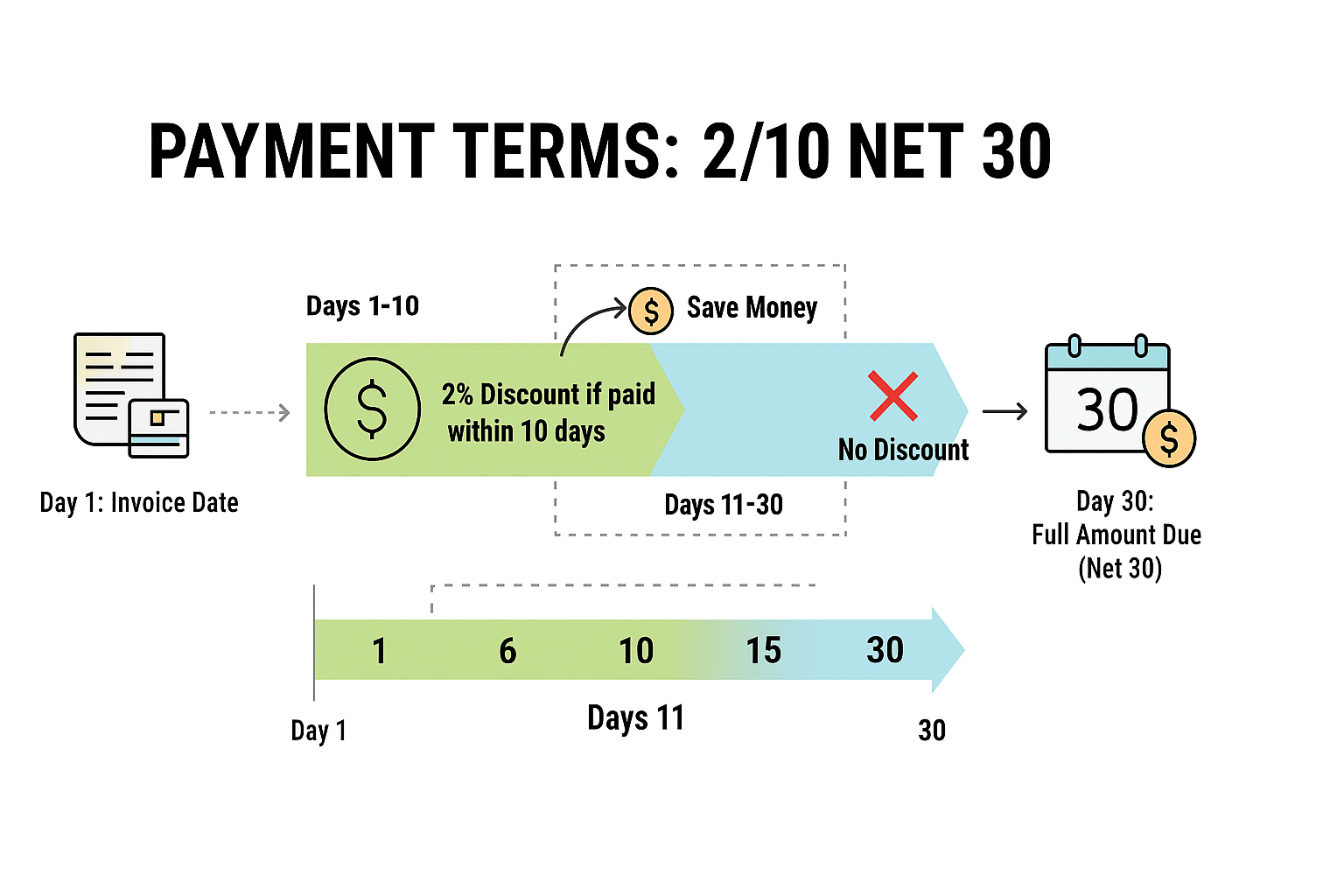

2/10 Net 30 is a common credit term used on invoices to encourage early payments. It means that a buyer can take a 2% discount on the invoice total if payment is made within 10 days. If the discount is not taken, the net (full) amount is due within 30 days from the invoice date.

Breaking Down the Term

- “2” – The discount percentage offered (2%).

- “10” – The discount period in days (must be paid within 10 days).

- “Net 30” – The full invoice amount is due within 30 days if no discount is taken.

How It Works

If a supplier issues an invoice for $5,000 with 2/10 Net 30 terms, the buyer can either:

- Pay within 10 days and take a 2% discount: $5,000 − $100 = $4,900.

- Pay the full $5,000 by day 30 without any discount.

Why Businesses Use It

- Improved cash flow: Encourages buyers to pay sooner, providing suppliers with faster access to cash.

- Reduced credit risk: Shortens the collection period, lowering the risk of late or unpaid invoices.

- Customer incentive: Provides buyers with a financial reason to prioritize early payment.

Impact on Buyers

For buyers, taking advantage of the discount can be highly beneficial. A 2% savings for paying 20 days early often translates into an annualized return much higher than most investment opportunities. Many financial managers view early payment discounts like this as a very cost-effective use of funds.

When to Use 2/10 Net 30

Suppliers commonly use 2/10 Net 30 when:

- They want to speed up collections without pressuring customers too harshly.

- They are working with new clients and want to encourage reliable payment habits.

- They are in industries with thin margins where cash flow is critical.

Considerations for Sellers

- Offering a discount reduces revenue slightly but can improve liquidity.

- It is most effective when suppliers need cash faster to reinvest in operations.

- Overuse may reduce profitability if too many buyers always take the discount.

Example in Practice

A wholesaler selling to a retail store includes 2/10 Net 30 on its invoices. The retailer usually takes advantage of the 2% discount by paying within 10 days, which saves money on purchases while giving the wholesaler quick access to cash to restock inventory and manage operating expenses. If the retailer chooses not to take the discount, full payment is still expected by day 30.

Key Takeaway

2/10 Net 30 is a win-win tool: suppliers improve cash flow and reduce risk, while buyers save money if they pay promptly. Both sides benefit when terms are applied consistently and strategically.

For more details, see 2/10 Net 30 on Investopedia.