Opening a restaurant is an exciting journey filled with passion, creativity, and ambition. Yet one of the biggest challenges every aspiring restaurateur faces is securing the necessary funds to bring their vision to life. Understanding how to get funding for a restaurant is not just about finding money—it’s about choosing the right financing strategy that matches your goals, concept, and growth potential. Whether you’re launching a new dining concept or expanding your existing brand, this guide will walk you through proven strategies to fund your restaurant successfully.

Table of Contents

- Crafting a Strong Restaurant Business Plan

- Exploring Small Business Loans and SBA Options

- Finding Investors and Private Funding Sources

- Using Crowdfunding and Alternative Financing

- Applying for Grants and Restaurant Funding Programs

- Empowering Your Restaurant’s Growth with Biyo POS

- Frequently Asked Questions

Crafting a Strong Restaurant Business Plan

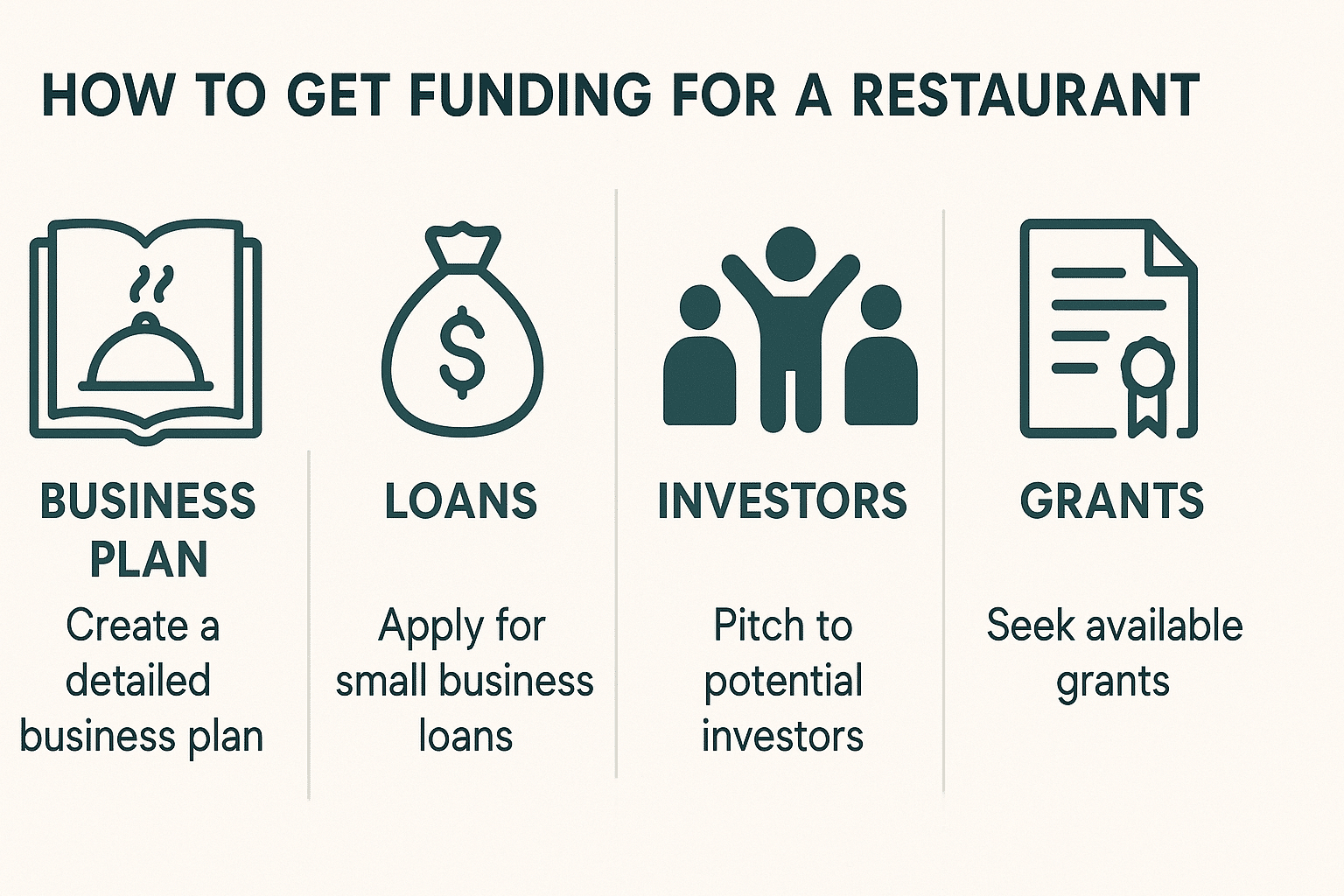

A well-structured business plan is the foundation of every successful restaurant funding strategy. It communicates your vision, structure, and profitability to potential lenders and investors. If you want to learn how to get funding for a restaurant, the first step is building a clear and compelling business plan that outlines your concept, market positioning, and financial roadmap.

Understanding the Importance of a Detailed Business Plan

Your business plan is more than a document—it’s your restaurant’s financial blueprint. Investors and lenders use it to evaluate your ability to generate revenue, manage expenses, and sustain long-term growth. When writing this plan, make sure it includes an executive summary, menu concept, location analysis, target market, and marketing strategy. Each section helps build investor confidence by showing that you’ve thought through every aspect of your business.

A detailed plan also forces you to think critically about your restaurant’s identity. What sets your concept apart from others in the market? Whether you’re introducing a farm-to-table bistro or a fast-casual burger joint, clarity in your concept defines how you will appeal to customers and investors alike. Your ability to communicate this uniqueness often determines whether you’ll attract serious funding offers.

Finally, your business plan should include operational details. Outline supplier relationships, staffing requirements, and day-to-day management systems. This demonstrates your preparedness to handle the complex logistics of restaurant ownership—something lenders value highly when assessing risk.

Creating Realistic Financial Projections

Financial projections are essential for convincing banks and investors that your restaurant can achieve profitability. Include projected revenue, startup costs, and operating expenses for at least three years. Estimate your daily sales, average check size, and customer traffic to create an accurate financial picture.

Use actual data whenever possible. Study competitors, local demographics, and seasonal dining trends to ensure your figures make sense. For example, a seafood restaurant near the coast may experience high summer sales but lower winter revenue. Showing awareness of such patterns makes your plan more credible and reduces perceived risk.

It’s also wise to break down expenses into categories like rent, utilities, payroll, and marketing. Detailed expense management shows that you understand your restaurant’s cost structure. When investors see that you’ve considered every detail—from napkin costs to liquor licensing fees—they’re far more confident in your leadership.

To strengthen your funding proposal further, include clear assumptions about growth. If you plan to open multiple locations, show when and how you’ll reach that milestone. Financial realism paired with vision demonstrates strategic thinking—something every serious funder looks for.

Presenting a Persuasive Funding Proposal

Your funding proposal should tell a compelling story about your restaurant’s potential. Begin with a clear funding request: how much you need, where it will go, and what investors gain. Use visuals—such as profit forecasts, graphs, and cost breakdowns—to simplify your message and make complex data easy to digest.

When presenting to lenders, emphasize repayment capability. For example, show a repayment schedule that aligns with expected revenue growth. When talking to investors, focus instead on profitability and exit potential. Tailor your pitch to your audience’s goals to create alignment from the start.

Storytelling plays a huge role. Frame your restaurant as an investment opportunity that blends passion with numbers. Describe the customer experience, your brand’s personality, and why your restaurant fills a gap in the market. Emotion backed by evidence creates a powerful funding narrative that wins trust and capital.

Rehearse your presentation multiple times before meeting investors. Anticipate tough questions about competition, staffing, or cash flow. The more confidently you respond, the more credible you appear. Remember, preparation converts hesitation into commitment.

Exploring Small Business Loans and SBA Options

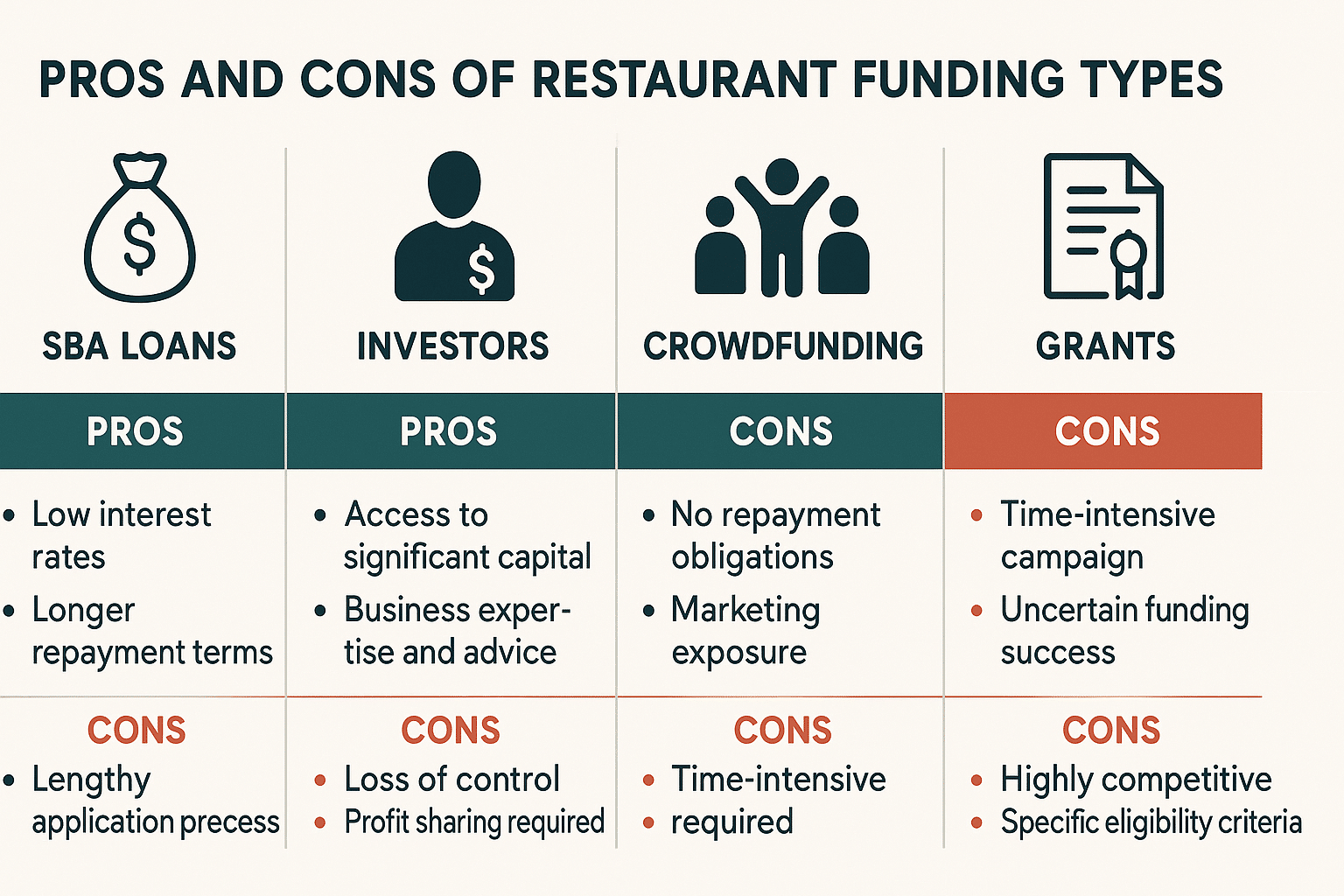

One of the most common ways to get funding for a restaurant is through business loans. From traditional bank loans to SBA-backed programs, there are several options designed specifically to support small business owners in the hospitality industry.

Understanding Different Types of Restaurant Loans

Restaurant financing comes in many forms, and choosing the right one depends on your business stage and funding purpose. Term loans are perfect for large one-time expenses like build-outs or renovations. Short-term loans work well for quick capital injections during busy seasons. Equipment financing covers critical assets such as kitchen appliances, POS systems, and furniture without requiring full upfront payment.

Lines of credit are another flexible option, ideal for managing working capital or handling emergencies. They allow you to draw funds when needed and pay interest only on what you use. This flexibility can help you navigate slow seasons without affecting day-to-day operations.

Microloans—typically under $50,000—can be a great entry point for new restaurant owners who don’t yet qualify for large bank loans. They’re often available through community lenders or nonprofit organizations that support small businesses.

Before applying, review each option’s interest rate, term length, and qualification requirements carefully. Comparing multiple lenders helps you secure the best deal and avoid long-term financial strain.

Applying for SBA Loans

The U.S. Small Business Administration (SBA) offers some of the most reliable financing options for restaurant owners. SBA 7(a) loans are perfect for general business expenses, while SBA 504 loans fund long-term assets like property and major equipment. With competitive rates and longer repayment periods, these programs are highly popular among restaurateurs.

The application process requires detailed paperwork—business plan, cash flow statements, and credit history—but patience pays off. Because the SBA guarantees a large portion of each loan, banks are more likely to approve applicants who might otherwise be overlooked.

Many restaurant owners use SBA loans to refinance high-interest debt, expand into new locations, or purchase commercial real estate. Their flexibility makes them a cornerstone of restaurant financing strategies.

To improve your approval odds, build a strong relationship with your bank early. Keep accurate records, maintain solid credit, and be transparent about your goals. Banks prefer working with borrowers who demonstrate both financial discipline and business acumen.

Working with Private Lenders and Alternative Financing

Private lenders and alternative financing platforms have revolutionized small business funding. They offer quick approvals, minimal paperwork, and access to capital even for owners with limited credit history. These lenders often assess your restaurant’s sales data rather than relying solely on credit scores.

Merchant cash advances, for instance, provide funds upfront in exchange for a percentage of your daily sales. This can be helpful if you experience consistent revenue but lack immediate liquidity. However, it’s essential to read the fine print, as interest rates may be higher than traditional loans.

Another alternative is revenue-based financing, where repayments scale with your monthly income. This flexibility keeps your business comfortable during slower months while allowing faster repayment when sales surge.

Private lenders are ideal for short-term financing needs or when speed matters. Still, always balance convenience with cost—calculate the total repayment amount and ensure it aligns with your projected profit margins before signing any agreement.

Finding Investors and Private Funding Sources

Beyond loans, investor funding plays a vital role in helping restaurants launch and expand. Attracting investors requires clarity, persuasion, and a strong growth story. Understanding how to get funding for a restaurant through private investment can set your business apart in a crowded market.

Pitching to Angel Investors

Angel investors are individuals who invest personal funds in promising startups in exchange for equity or convertible debt. They often bring mentorship, networking opportunities, and business advice along with money. To attract them, focus on your restaurant’s innovation, concept appeal, and profit potential.

Showcase unique elements that make your restaurant stand out—perhaps a fusion cuisine concept, a sustainable sourcing model, or a strong digital marketing strategy. Angel investors look for differentiation combined with a feasible path to revenue.

Transparency is key. Be open about startup costs, potential risks, and your timeline for returns. Back up your claims with research and hard data, not just enthusiasm. When investors feel you’re realistic and accountable, they’ll be more inclined to invest.

Lastly, emphasize personal chemistry. Angel investors often fund entrepreneurs they trust and connect with. Building rapport can be just as important as presenting numbers.

Exploring Venture Capital Opportunities

Venture capital (VC) firms invest in high-growth businesses capable of rapid expansion. While rare in traditional restaurants, VCs are increasingly drawn to innovative food brands—especially those using technology, automation, or unique franchise models.

To secure VC funding, demonstrate scalability. Show that your restaurant can be replicated efficiently, whether through franchising, licensing, or tech-enabled operations. Back this with data on customer demand, location performance, and operational consistency.

Build a presentation that highlights both financial upside and brand potential. Investors want to see not only profits but also cultural impact. If your restaurant concept taps into consumer trends like plant-based dining or experiential eating, emphasize that advantage clearly.

Remember, venture capitalists expect a return on investment. They’ll want input on decisions and possibly a seat at the table. Make sure their goals align with yours before finalizing any deal.

Forming Partnership Investments

Partnership investments let multiple people contribute capital while sharing ownership and profits. They’re especially effective when partners bring complementary expertise—one handling operations, another managing marketing, and another providing funding.

Start by establishing clear legal terms. Define each partner’s investment amount, responsibilities, and decision-making authority. Use a lawyer to draft the agreement and avoid future misunderstandings. Transparency builds trust and long-term collaboration.

Partnerships also reduce individual risk. When costs, responsibilities, and profits are shared, the business becomes more resilient. For instance, one partner may specialize in supplier relations while another focuses on customer acquisition, creating a balanced management structure.

For many restaurateurs, partnerships provide the perfect blend of funding and teamwork to ensure sustainable growth and success.

Using Crowdfunding and Alternative Financing

In today’s digital world, crowdfunding has become one of the most exciting and accessible ways to get funding for a restaurant. It allows entrepreneurs to raise money from the public while building brand awareness before launch.

Launching a Crowdfunding Campaign

Platforms like Kickstarter, Indiegogo, and GoFundMe allow restaurant owners to present their vision directly to potential supporters. The key to success lies in storytelling. Explain your restaurant concept vividly, include high-quality images or videos, and share your motivation for starting this journey.

Offer tiered rewards that appeal to backers. These could range from branded merchandise and gift cards to private dining events or menu-naming privileges. Creative incentives not only encourage contributions but also build emotional investment in your brand.

Promote your campaign aggressively across social media, local media outlets, and email lists. Partner with influencers or local food bloggers to expand reach. A viral campaign doesn’t just raise money—it creates buzz before you even open your doors.

Track progress transparently. Regular updates keep your audience engaged and demonstrate professionalism. Once the campaign ends, fulfill all promises promptly to build long-term trust and credibility.

Exploring Equity Crowdfunding Options

Equity crowdfunding combines traditional investment principles with the accessibility of online fundraising. Platforms like WeFunder, Republic, and StartEngine enable you to sell small equity stakes to individual investors who believe in your concept.

This approach transforms loyal customers into brand advocates. Investors often become your first and most passionate patrons, promoting your restaurant within their communities. That organic word-of-mouth can be as valuable as the funding itself.

To succeed, transparency is critical. Disclose your financials, growth strategy, and business risks clearly. Build a professional profile that instills confidence. Many successful campaigns include behind-the-scenes videos showing team members, food tastings, or site visits.

Equity crowdfunding not only provides capital but also cultivates a devoted audience invested in your restaurant’s journey. Their ongoing support can sustain your growth long after funding ends.

Using Equipment Financing

Equipment financing helps restaurants acquire expensive kitchen appliances, POS systems, or furniture without massive initial payments. The equipment itself acts as collateral, reducing risk for lenders and allowing easier approval for new entrepreneurs.

This option is especially beneficial when launching a first location or upgrading operations. Instead of draining your cash reserves, you can spread payments over several months or years while keeping liquidity for marketing or hiring.

Compare financing terms carefully. Some lenders include maintenance support or flexible repayment schedules. Evaluate the total cost over time versus outright purchase—sometimes leasing may be smarter than buying, depending on depreciation and tax benefits.

Strategic use of equipment financing lets you modernize your restaurant efficiently and maintain a healthy cash flow, positioning your business for steady growth.

Applying for Grants and Restaurant Funding Programs

While grants are more competitive than loans, they offer a powerful advantage: they don’t require repayment. Many government and private organizations provide grants to help restaurants recover, grow, or innovate. Learning how to get funding for a restaurant through these programs can significantly reduce your financial burden.

Finding Federal and State Grants

Federal and state agencies regularly release grant programs that support small businesses in hospitality, sustainability, and community development. The U.S. Department of Agriculture (USDA) and Small Business Innovation Research (SBIR) programs occasionally provide food industry grants.

To maximize your chances, tailor each application carefully. Emphasize how your restaurant benefits the local economy—whether through job creation, local sourcing, or sustainable practices. Back up claims with measurable outcomes and testimonials when available.

Track deadlines and use grant databases such as Grants.gov to find the most relevant opportunities. Create a calendar for recurring grants to ensure you never miss submission windows. Persistence often pays off, as many successful recipients apply multiple times before winning approval.

Government grants require patience and precision, but the payoff can be game-changing for your restaurant’s financial stability.

Exploring Private and Nonprofit Grants

Corporate foundations, industry associations, and nonprofits often sponsor grants for underrepresented or innovative restaurateurs. For instance, programs like the James Beard Foundation’s Open for Good initiative have supported thousands of independent restaurants nationwide.

These grants typically focus on specific goals such as workforce development, sustainability, or culinary innovation. Align your proposal with the organization’s mission to improve your odds. For example, a restaurant focused on farm-to-table dining can apply for environmental or agricultural sustainability grants.

Building relationships with local chambers of commerce, culinary schools, and food industry associations can uncover opportunities not listed online. Networking and reputation often open doors to private funding sources.

Nonprofit grants may not cover all startup costs, but they can fund crucial initiatives like training, marketing, or community outreach—strengthening your restaurant’s foundation.

Combining Grants with Other Funding Sources

Smart restaurateurs rarely rely on a single funding method. Combining grants with loans, equity investment, or crowdfunding helps create a diversified capital stack that minimizes risk and enhances flexibility.

For example, a small SBA loan can fund construction, while a local business grant supports marketing or hiring. Crowdfunding can cover initial publicity, and an angel investor can provide ongoing growth capital. This layered approach ensures financial security even if one source delays or underdelivers.

Maintain detailed documentation of each funding stream and its intended use. Transparency reassures stakeholders and demonstrates strong management skills. Regular reporting builds trust and keeps investors informed of progress.

Empowering Your Restaurant’s Growth with Biyo POS

Once you’ve secured your restaurant financing, managing operations efficiently is the next critical step. That’s where Biyo POS comes in. Designed specifically for restaurants and cafes, Biyo POS helps streamline payments, track inventory, and manage employees—all in one cloud-based platform. It supports advanced financial reporting, multi-branch management, and real-time insights, making it the perfect companion for data-driven restaurateurs.

Biyo POS isn’t just a payment processor—it’s a growth engine. With built-in analytics, you can identify your best-selling menu items, monitor labor costs, and make informed financial decisions every day. Features like offline functionality, staff permissions, and seamless integrations with accounting tools make management effortless.

Schedule a personalized demo to see how Biyo POS can simplify your daily operations and elevate profitability. Book a call here or sign up today to build a smarter, more efficient restaurant business.

Frequently Asked Questions

What is the best way to get funding for a restaurant?

The best way depends on your goals and credit history. Many restaurateurs combine SBA loans, private investors, and crowdfunding to balance risk and flexibility.

Can I start a restaurant with no money?

Yes, but it requires creativity. You can start small with a pop-up or food truck, partner with investors, or use crowdfunding to raise your initial startup capital.

Are there grants for new restaurant owners?

Yes, federal, state, and private grants exist for restaurant startups, especially those promoting sustainability or community development. Research programs on official grant websites and apply early.

How much does it cost to open a restaurant?

Startup costs vary by concept and location, but on average, new restaurants spend between $250,000 and $500,000 on build-out, equipment, and licensing.

Can I use Biyo POS to manage my restaurant finances?

Absolutely. Biyo POS provides real-time financial insights, sales tracking, and reporting tools that help restaurant owners manage operations efficiently and make data-driven funding decisions.