Ready to ditch the clunky cash register and start taking payments right from your pocket? You're in the right place. To accept credit cards on your phone, you really only need three key things: a smartphone you already own, a compact mobile card reader, and a Point of Sale (POS) app like Biyo.

This simple setup turns your phone into a secure and powerful payment terminal, giving you the freedom to do business absolutely anywhere. Think of it as your modern-day register, but without the bulk and high cost.

Turn Your Phone Into a Powerful POS System

Let's be honest, staring at an old-school cash register feels like a throwback, especially when the supercomputer in your pocket can do so much more. The great news is that your smartphone is all you need to create a modern point of sale. This guide is built for the small business owner on the go—the freelancer meeting a client for coffee, the artist at a weekend market, or the food truck owner in a new spot every day.

We're going to walk through exactly how to get started, so you can forget about complicated hardware and expensive contracts. It’s all about a straightforward, affordable way to meet your customers where they are, ready to pay with a quick tap, swipe, or chip insert. To get a better handle on the big picture, it helps to understand what a point of sale system is and how all the pieces work together.

The Shift to Mobile Payments

The move to mobile payments isn't just some passing fad; it's a real shift in how people prefer to pay. Your customers expect fast and easy checkout experiences, and businesses that deliver on that are the ones that succeed. With mobile wallets and contactless "tap-to-pay" becoming the norm, taking credit card payments on your phone is now standard practice.

The numbers don't lie. By 2025, it's expected that around 90% of U.S. merchants will accept mobile payments like Apple Pay and Google Pay. On top of that, contactless payments already account for about 50% of all in-person transactions worldwide. It's clear customers love a frictionless checkout.

To see how this all fits into the bigger payment ecosystem, it's worth exploring the various mobile payment solutions out there. This will give you a complete view of how your new mobile POS is part of a much larger transformation in commerce.

Your Mobile Payment Toolkit

Here are the three essential components you need to start accepting credit card payments on your smartphone.

| Component | What It Does | Why It's Essential |

|---|---|---|

| Smartphone or Tablet | Runs your POS app and connects to the card reader. | This is the "brain" of your entire operation, putting payment processing power right in your hand. |

| Mobile Card Reader | Securely captures card information via swipe, chip, or tap. | A dedicated reader ensures every transaction is encrypted and secure, protecting both you and your customer. |

| POS App (like Biyo) | Manages inventory, processes payments, and tracks sales. | This is the software that connects everything, turning transaction data into useful business insights. |

With these three pieces working together, you have a complete, professional-grade system that's ready to go wherever your business takes you.

Choosing and Connecting Your Mobile Card Reader

Before you can ring up that first sale on your phone, you need a critical piece of gear: a mobile card reader. Think of this little device as the handshake between your customer's card and your Biyo POS app. Picking the right one is the first real step to taking credit card payments wherever you do business.

There are a ton of readers out there, from simple old-school swipers to all-in-one powerhouses. To keep your customers happy and your sales flowing, you'll want a reader that can handle how people actually pay today.

Selecting the Right Reader for Your Business

Your goal is to find a reader that supports the three main ways customers will hand you their money. Having a versatile device means you’ll never have to say, "Sorry, we don't take that."

Make sure your reader can handle:

- Chip (EMV): This is the "dip" method and the gold standard for security. It's an absolute must-have to protect your business from fraud.

- Contactless (NFC): "Tap-to-pay" is all about speed. This is how customers use their physical cards or mobile wallets like Apple Pay and Google Pay. It’s no longer a nice-to-have; it's an expectation.

- Swipe (Magstripe): While it's being phased out, you'll still run into older cards. Having a swipe option is a solid backup.

Let's put this in context. A bustling coffee truck owner lives and dies by speed, so an NFC-ready reader is essential for busting through the morning rush. On the other hand, a wedding photographer shooting on-location needs a compact, reliable reader that does it all and fits neatly into a gear bag. Biyo POS works with readers that cover all these scenarios.

The real secret is matching the hardware to your workflow. A reader that accepts every payment type doesn't just make for a smoother checkout; it also prepares your business for whatever payment trends come next. For a deeper look, check out our guide explaining what makes a great mobile card reader.

Connecting Your Reader via Bluetooth

Got your reader out of the box? Getting it connected is pretty simple. First things first, give it a full charge with the included USB cable. I can't tell you how many "connection issues" I've seen that were really just a dead battery.

Once it's charged up, turn the reader on and make sure Bluetooth is enabled on your smartphone.

Here's a key tip: don't pair it through your phone's main Bluetooth settings menu. Instead, open the Biyo POS app directly. Go to the settings or hardware section inside the app, and you'll see prompts to find and connect your reader. The app is designed to locate the device and create a secure, stable link that you can count on for every transaction. This in-app pairing is the most reliable way to get set up for your first sale.

Getting Your Biyo POS App Ready for Sales

With your card reader paired up, the next stop is the Biyo POS app. Think of it as your digital command center. A little bit of thoughtful setup now will pay off big time, making every transaction feel effortless and professional down the line.

The first thing you'll want to tackle is your product library. A well-organized item list is a lifesaver when you've got a line of customers. Put yourself in their shoes and group things logically—think "Hot Drinks" and "Pastries" if you're running a cafe. Give everything a clear name and price. This simple bit of organization makes ringing up a sale worlds faster.

Customizing Settings for a Polished Checkout

Now, let's get the financial details squared away. Dive into the Biyo POS settings to set up your tax rates. Getting this right from day one saves you from major accounting headaches later on. This is also where you can customize your digital receipts—add your logo and contact info for a branded, professional touch that customers will remember.

Pro Tip: The goal here is a completely smooth experience for both you and your customer. Spending a few extra minutes organizing the app now means you can process a credit card payment in seconds. That's how you keep lines short and customers happy.

This preparation is more important than ever, especially when you look at how younger customers prefer to pay. In the UK, a staggering 78% of consumers aged 16–24 and 67% of those aged 25–34 used a mobile payment service in 2023. A quick, modern checkout isn't just a nice-to-have; it's an expectation.

Building Out Your Product Library

Here’s a practical tip for building your product list: use variants. Say you sell a t-shirt that comes in multiple sizes and colors. Instead of creating a dozen separate items that clutter your screen, create a single product and add "Size" and "Color" as variants. This keeps your main sales screen clean and makes inventory tracking way more accurate.

Once your products, taxes, and receipts are all set, you're officially open for business. The app is now fully armed to handle sales, keep track of your stock, and give every customer a polished experience from start to finish.

How to Process Your First Mobile Transaction

Alright, you've got your hardware connected and the Biyo POS app is all set up. Now for the fun part: making your first sale. This is where all that prep work pays off, turning what could be a clunky process into a seamless one for your customer.

Let's walk through a typical transaction.

Picture a customer at your weekend market booth. They've decided on a handmade candle and a bar of soap. On your phone, you'll just tap those two items in your Biyo POS product library. The app immediately pulls them into the cart, calculates the total, and adds the sales tax you set up earlier. Everything is displayed right there on the screen. No guesswork.

Taking the Payment

Once you've confirmed the items, hit the “Charge” button. This is your signal to present the phone and card reader to your customer. They'll see clear prompts on the screen, guiding them to either tap their contactless card, insert their chip card, or use a mobile wallet like Apple Pay.

The approval is almost instant. As soon as it goes through, the app gives you a success confirmation. From there, you can add a tip if they wish and then send a digital receipt directly to their email or via SMS. The whole exchange, from start to finish, is designed to be incredibly fast.

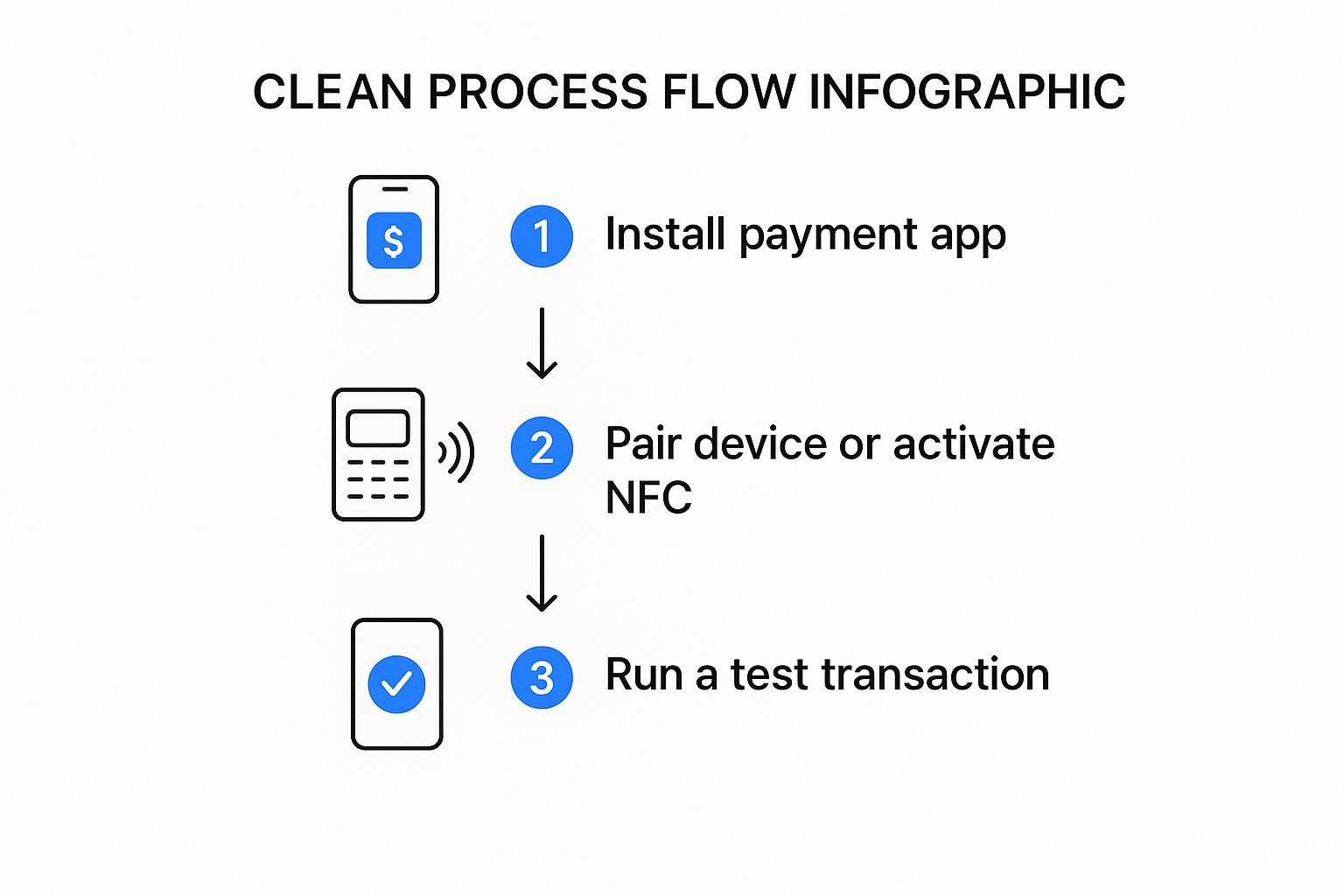

This simple flow shows just how straightforward it is to get your hardware ready for that first transaction.

The big idea here is that modern POS systems have completely removed the old technical hurdles. Accepting credit cards on your phone is now genuinely easy.

Handling Real-World Scenarios

But what about those less-than-perfect situations? For example, what if a customer wants to split the payment across two different cards? No problem.

Biyo POS is built for this. You'll simply enter the amount for the first card and process it. The app then automatically prompts you to charge the remaining balance to the second card. It’s a common request, and the software handles it gracefully.

Issuing a refund is just as straightforward. All you have to do is find the original transaction in your sales history and you can process a full or partial refund right back to their card. Getting comfortable with these common scenarios is what will give you the confidence to handle any customer request thrown your way.

Getting a Handle on Fees and Security

When you start accepting credit cards on your phone, you’re doing more than just adopting new tech—you're building a system based on trust. Getting a solid grasp of the costs and the security that backs it all up is crucial for protecting your business and your customers.

Let's talk about the fees first. They can seem a bit complicated, but they usually boil down to a couple of common models. Many mobile POS systems, like Biyo POS, keep things simple with flat-rate pricing. You pay a predictable percentage plus a small fixed fee on every single transaction, regardless of the card brand. Easy peasy.

The other main model you'll see is interchange-plus. Here, the fee is a mix of the base rate from card networks (like Visa or Mastercard) and the processor's markup. It can sometimes be cheaper, but it's definitely harder to predict your monthly costs. The best move is always to compare mobile payment processing fees to see which structure makes the most sense for your business.

How Every Transaction Stays Safe

Beyond the numbers, security is the absolute top priority. Modern POS apps are packed with powerful tech designed to protect sensitive card data from the second it's tapped, dipped, or swiped. Two of the biggest players here are tokenization and end-to-end encryption.

Here’s a quick rundown of how they work together to protect you:

- End-to-End Encryption: This process instantly scrambles card data the moment it leaves the reader. It stays scrambled until it reaches the payment processor, which means it’s completely unreadable to any prying eyes along the way.

- Tokenization: Instead of storing the actual card number, this technology replaces it with a unique, one-time-use code—a "token." This means your customer's real card details are never sitting on your phone or in your POS system.

Think of it this way: even if a hacker managed to intercept the transaction data, all they’d find is a useless, encrypted token. This is the kind of robust security that makes taking payments on your phone every bit as safe as using a classic countertop terminal.

This level of protection is essential, especially when you consider that there are over 631 million active credit card accounts in the U.S. alone, with that number constantly climbing. Businesses everywhere are adapting to this reality.

Your role in this is simple but important. Always keep your Biyo POS app updated to the latest version, since updates often include critical security patches. And, it should go without saying, but never write down a customer's credit card information. When you combine smart habits with secure technology, you create a payment experience everyone can trust.

Common Questions About Mobile Payments

Switching to mobile payments is exciting, but it's natural to have a few questions. Getting a handle on the common "what-ifs" is the best way to feel confident when you're learning how to accept credit cards on your phone. Let's walk through some of the things new merchants often ask.

What if My Card Reader Won't Connect?

One of the most common hiccups is a simple connectivity issue. Your customer is ready to pay, but the card reader just isn't talking to your phone. Don't panic; it's usually an easy fix.

Before you get too deep into troubleshooting, run through this quick checklist:

- Check the Power: Is the card reader fully charged? A low battery is the number one reason for pairing failures.

- Bluetooth On?: Make sure your phone's Bluetooth is actually enabled. It sounds obvious, but we’ve all been there.

- A Quick Reboot: Sometimes, all it takes is a classic "turn it off and on again." Restart both your phone and the card reader to clear out any temporary glitches.

If you’ve tried all that and still have no luck, it’s time to reset the connection completely. Go into your phone’s Bluetooth settings, find the reader in your device list, and tap “Forget this Device.” Now, head back to the Biyo POS app and start the pairing process again from scratch. This almost always creates a fresh, stable link.

How Quickly Do I Get My Money?

This is a big one for every business owner. You've made the sale, but when does that money actually land in your bank account?

With a modern system like Biyo POS, you can generally expect funds to be deposited within 1-2 business days. Just remember that bank processing schedules apply. A sale you make on a Friday evening or over a holiday weekend won't process until the next business day, so you'll likely see it appear on Tuesday.

The key takeaway is that while the transaction is instant for your customer, the back-end transfer to your bank account operates on a standard business day schedule.

Can I Take Payments Without Internet?

Absolutely. This is a huge advantage of using a dedicated POS app. What happens if you're at a farmer's market, a food truck event, or just in a building with terrible Wi-Fi?

Most robust systems, including Biyo POS, come with an Offline Mode. This feature is a lifesaver. It lets you continue to accept swiped card payments even when you're completely disconnected from the internet. The app securely stores the encrypted transaction details on your device.

The moment you reconnect to Wi-Fi or cellular data, the app automatically processes all the queued payments. You don’t have to do a thing.

Ready to turn your phone into a powerful, secure, and easy-to-use payment system? Get started with Biyo POS today and discover how simple it is to manage your business from anywhere. Try our 14-day free trial and see the difference for yourself.