Learning how to accept contactless payments is no longer optional for modern businesses. Customers now expect fast, secure, and touch-free transactions whether they are buying a coffee, groceries, or retail products. From NFC technology and mobile wallets to QR code payments and wearable devices, the options are expanding rapidly. If your business wants to keep up with consumer demand and stand out from competitors, integrating contactless payments is a smart move. In this guide, we’ll walk through everything you need to know to get started.

Table of Contents

- What Are Contactless Payments?

- Technology Powering Contactless Transactions

- How to Set Up Contactless Payments

- Benefits of Accepting Contactless Payments

- Security and Compliance in Contactless Payments

- How Biyo POS Helps You Accept Contactless Payments

- FAQ on How to Accept Contactless Payments

What Are Contactless Payments?

Before exploring how to accept contactless payments, it’s helpful to understand what they are and why they matter. Contactless payments are a form of cashless transaction where customers pay by simply tapping their card, phone, or wearable device against a contactless card reader. Instead of swiping or inserting a card, the transaction takes place wirelessly within seconds.

Definition and Basics

Contactless payments use technologies like near-field communication (NFC) and quick response (QR) codes. Customers place their card or smartphone close to a wireless terminal, and the system instantly communicates with the payment processor. Unlike traditional methods, there’s no need for physical contact with the terminal. This method is designed to make checkout faster, smoother, and more secure.

These systems are supported by most modern banks and credit card companies. Cards today often include EMV chips with built-in tap-to-pay functionality. Smartphones and wearables offer mobile wallet integration, meaning customers can store multiple cards digitally. This growing ecosystem has made it easier for businesses of all sizes to adopt contactless solutions.

For merchants, adopting contactless payments not only reduces cash handling but also creates a cleaner, safer experience. In busy environments like cafés or grocery stores, every second matters. Shortening checkout times leads to happier customers and higher sales volume.

Why Customers Prefer Them

Speed is the number one reason people love contactless payments. Customers no longer wait for cards to be inserted, chips to process, or cash to be counted. Instead, they tap and go. This creates a faster checkout experience, especially during peak hours, which can significantly cut waiting lines.

Convenience is another factor. With digital wallets like Apple Pay or Google Wallet, people don’t need to carry multiple cards or cash. They can pay directly with their smartphone or smartwatch. Wearable payments like fitness trackers or rings also give consumers a futuristic, hands-free option that feels natural and efficient.

Finally, hygiene plays a role. After recent global health concerns, many customers prefer touch-free payments. By reducing physical contact at the checkout counter, businesses provide a safer environment, which increases trust and repeat visits.

Market Adoption and Growth

Contactless payments have seen exponential growth in recent years. According to industry studies, over 70% of consumers in developed markets now use contactless technology regularly. Countries like the UK, Canada, and Australia report that more than half of in-person transactions happen via tap-to-pay or digital wallets.

Small businesses are also catching up. Food trucks, local coffee shops, and independent retailers are now offering wireless payment processing using mobile POS systems. These solutions are affordable and scalable, allowing even small vendors to keep up with large competitors. For many customers, the ability to pay quickly is a deciding factor in where they shop.

Financial institutions continue to push adoption by issuing tap-enabled debit and credit cards. Governments in some regions also encourage digital payment systems as part of efforts to reduce reliance on cash. The trend is clear: learning how to accept contactless payments is essential for long-term business success.

Technology Powering Contactless Transactions

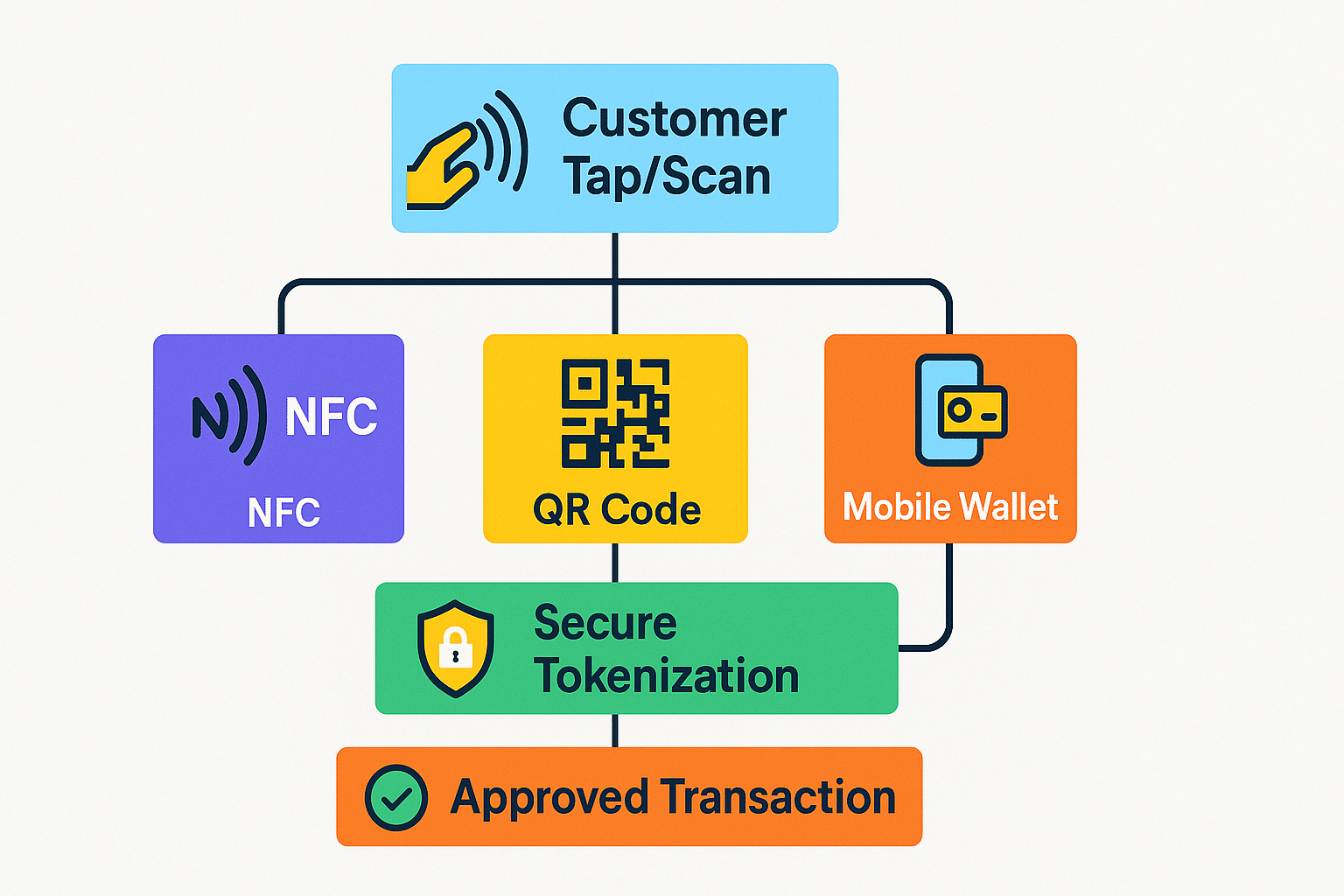

Understanding the technology behind contactless payments will help you make better decisions when setting up your system. The main drivers are NFC technology, QR code payments, tokenization, and POS integration. Each plays a key role in ensuring transactions are seamless, secure, and reliable.

NFC and Tap-to-Pay

NFC technology allows devices to communicate wirelessly over short distances. When a customer taps their phone or card near a terminal, NFC transmits encrypted data to the payment processor. The whole process takes just a few seconds and doesn’t require internet access to initiate. This makes it reliable even in high-volume environments.

Tap-to-pay has become the default method for many consumers. It works with mobile wallets like Apple Pay, Google Wallet, and Samsung Pay, which support multiple cards and loyalty programs. Businesses that accept NFC payments open the door to a wide range of customer preferences, from contactless debit cards to wearable payments.

For merchants, upgrading to an NFC-enabled POS terminal ensures compatibility with the most popular payment methods. Without it, businesses risk appearing outdated and losing sales to competitors who already support modern checkout experiences.

QR Code Payments

QR code payments are popular in regions where smartphones dominate but NFC adoption is slower. In this system, businesses display a QR code that customers scan with their phone. The scan directs them to a secure payment gateway where they confirm the amount and approve the transaction.

This method requires minimal investment, as businesses can use existing POS systems or even print QR codes for customer use. Restaurants, for instance, often include QR codes on tables or menus, allowing guests to order and pay without waiting for staff. Retailers also use QR codes for promotions, linking payment directly to discounts or loyalty programs.

While not as fast as tap-to-pay, QR code payments expand accessibility and convenience. They also reduce hardware costs, making them a viable solution for startups or mobile vendors testing cashless payment systems.

Tokenization and Secure Transactions

Tokenization replaces sensitive card details with a unique digital token. When customers pay via NFC or QR, the transaction doesn’t expose their card number. Instead, the token is verified by the processor and valid only for that specific transaction. If intercepted, the token is useless to attackers.

This approach reduces fraud risk and enhances customer confidence. Businesses benefit too, since they don’t need to store sensitive information on-site. Less data storage means fewer compliance burdens and reduced liability. Tokenization is now a standard feature in most payment gateways and processors.

When combined with EMV compliance and encryption, tokenization creates a secure environment for both merchants and consumers. It ensures contactless payments are as safe, if not safer, than traditional card swipes.

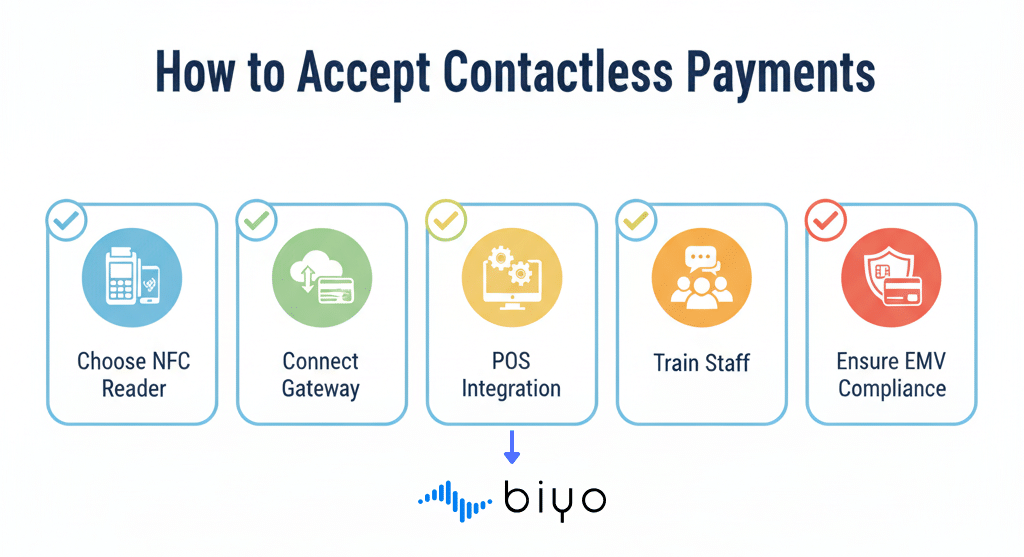

How to Set Up Contactless Payments

Now that you understand the technology, let’s go through the practical steps. Learning how to accept contactless payments involves choosing the right hardware, setting up a payment gateway, and integrating everything into your POS system.

Choosing Contactless Card Readers

Your first step is to purchase a contactless card reader or wireless terminal. These devices support tap-to-pay and mobile wallet payments. Some models are mobile, allowing businesses to process transactions on the go. For example, food trucks or pop-up shops can use portable POS systems to serve customers anywhere.

When choosing hardware, check compatibility with your payment processor. Some providers supply all-in-one packages that include a reader, software, and setup assistance. This simplifies adoption and ensures smooth integration with existing systems.

Quality hardware reduces checkout issues. A faulty or outdated reader not only slows down transactions but also frustrates customers. Investing in a reliable device ensures consistent performance and satisfied customers.

Integrating Payment Gateways

A payment gateway connects your POS system to banks and credit card networks. It verifies transactions, checks for fraud, and moves funds into your business account. Without it, contactless payments cannot be processed. Think of it as the bridge between your checkout counter and financial institutions.

Most processors provide gateways bundled with their services. Look for features such as tokenization, fraud detection, and support for mobile wallets. These add extra security and flexibility for your business. Gateways that integrate both online and offline payments provide an omnichannel advantage, letting customers pay seamlessly across platforms.

Choosing the right gateway is critical for smooth operations. A slow or unreliable system can cause delays at checkout, which negatively impacts the customer experience. Aim for a provider that guarantees uptime, offers technical support, and complies with industry standards.

POS Integration and Mobile Systems

POS integration ensures that your contactless payment setup connects with other business operations like inventory, reporting, and analytics. For example, if a customer pays via mobile wallet, the system should instantly update inventory levels and sales reports. This streamlines operations and saves manual work.

Mobile POS systems are especially useful for businesses operating outside traditional store setups. They allow staff to accept payments directly at tables, in queues, or at outdoor events. This flexibility boosts customer satisfaction and increases transaction speed. It also provides freedom to expand sales beyond fixed checkout counters.

Integration also supports customer loyalty programs. Some POS systems automatically link digital wallet purchases to rewards, encouraging repeat visits. The result is a more connected and customer-friendly business model that builds loyalty and drives growth.

Benefits of Accepting Contactless Payments

By now, you understand how to set up the system. But why should you invest in it? Accepting contactless payments delivers multiple benefits, including faster checkout, greater customer convenience, and stronger fraud protection.

Faster Checkout

Contactless systems dramatically reduce checkout times. Instead of swiping cards or counting change, customers tap their card or phone, and the transaction is completed within seconds. In busy retail stores or quick-service restaurants, this difference can mean serving dozens more customers per hour.

Shorter lines translate into higher customer satisfaction. People are more likely to revisit businesses where they don’t waste time waiting. This increased throughput improves sales volume and reduces lost revenue from impatient shoppers abandoning purchases.

Faster checkout also encourages impulse buying. When payment is easy, customers are more inclined to grab an extra item without worrying about long delays at the register.

Customer Convenience

Modern consumers expect multiple payment options. Offering tap-to-pay, mobile wallets, and wearable payments positions your business as forward-thinking and customer-centric. Customers enjoy the flexibility of choosing their preferred method, making them more likely to return.

Digital wallets often include loyalty features, which means customers can earn points automatically. For example, a café using Apple Pay loyalty integration allows customers to collect rewards without carrying physical cards. This seamless integration increases retention and brand loyalty.

When customers see that your business offers fast, flexible, and rewarding payments, they’re more likely to choose you over competitors who still rely on outdated cash-only systems.

Security and Fraud Reduction

Contactless payments are more secure than traditional methods. Tokenization ensures that sensitive card information never travels across networks. Instead, encrypted tokens verify transactions, making fraud far less likely. Combined with EMV compliance, this setup provides industry-leading security.

Fraud monitoring systems add another layer of protection. Many payment processors provide real-time alerts for suspicious activity. This reduces chargebacks and helps businesses avoid costly disputes. Customers also feel safer knowing their data is protected.

In today’s environment, security is as much about perception as reality. Customers are more likely to trust a business that demonstrates a commitment to safe, touch-free payments. This trust translates into long-term loyalty and consistent revenue.

Security and Compliance in Contactless Payments

Although contactless payments are secure, businesses must follow compliance standards to protect themselves and their customers. EMV compliance, PCI DSS rules, and encryption protocols all play a role in ensuring safe operations.

EMV Compliance

EMV compliance is required for all businesses accepting card payments. EMV stands for Europay, Mastercard, and Visa, and it defines global standards for secure card transactions. If your system doesn’t support EMV, you could be liable for fraudulent transactions, which can be financially damaging.

Modern POS systems and card readers are already EMV-compliant, but you should always verify with your provider. Compliance ensures that your business can accept both chip cards and contactless cards safely, protecting you from liability shifts.

Maintaining compliance not only reduces fraud risk but also signals professionalism. Customers feel safer knowing your business adheres to international security standards.

PCI DSS Requirements

PCI DSS (Payment Card Industry Data Security Standard) outlines requirements for handling cardholder data. Merchants must secure networks, restrict access to sensitive systems, and maintain regular security testing. While processors handle most of these responsibilities, you still play a role in ensuring compliance.

Failure to comply can lead to hefty fines, increased processing fees, or even the suspension of your ability to process cards. That’s why it’s critical to choose a payment provider that offers PCI-compliant solutions and guides you through the process.

Meeting PCI DSS requirements is not just about avoiding penalties. It’s about protecting your business reputation and building trust with customers who rely on your systems to safeguard their financial information.

Encryption and Fraud Prevention

Encryption protects data in transit by scrambling information so that unauthorized parties cannot read it. When combined with tokenization, encryption ensures that even if hackers intercept a transaction, the information is useless. End-to-end encryption is now standard for most modern POS systems.

Fraud prevention tools go hand in hand with encryption. Advanced monitoring systems detect unusual patterns, such as multiple high-value transactions in a short time. This proactive approach minimizes losses and prevents disputes before they escalate.

For businesses, these protections mean fewer chargebacks and more stable revenue streams. For customers, they provide reassurance that paying with a tap or QR scan is safe, secure, and trustworthy.

How Biyo POS Helps You Accept Contactless Payments

Learning how to accept contactless payments is much easier with the right partner. Biyo POS offers a complete solution that includes NFC-enabled POS hardware, QR code payment support, and integration with digital wallets. Our system is designed for speed, security, and convenience, making it simple for businesses to embrace touch-free payments.

Biyo POS also provides advanced reporting, mobile POS systems, and multi-location management. This allows businesses to scale while maintaining full visibility across operations. Whether you run a single store or a growing chain, our platform ensures smooth, reliable, and secure payment processing.

Ready to get started? Schedule a call with our team for a walkthrough of our system, or sign up today and bring contactless payments to your business with confidence.

FAQ on How to Accept Contactless Payments

Do I need new hardware to accept contactless payments?

Yes, you’ll need a contactless-enabled card reader or wireless terminal. Many modern POS systems already include this hardware. If yours doesn’t, upgrading is simple and affordable.

Are contactless payments secure?

Absolutely. They use tokenization, encryption, and EMV compliance to keep transactions safe. These methods reduce fraud risk and protect sensitive information better than traditional card swipes.

Can small businesses use contactless payments?

Yes. Even small businesses can adopt mobile POS systems that support NFC and QR code payments. These solutions are cost-effective and scale with your business growth.

What if my customers don’t use mobile wallets?

Customers can still use tap-enabled debit and credit cards. Nearly all major banks now issue cards with contactless functionality, so adoption continues to grow every year.

How do QR code payments work for merchants?

Merchants display a QR code at checkout, on receipts, or on menus. Customers scan the code with their phone and complete the payment in their wallet app. It’s a low-cost and flexible way to support digital payments.