To take credit card payments, you obviously need a solid point-of-sale (POS) system that handles payment processing smoothly. But it’s more than just software; it involves physically connecting your card reader, setting up a merchant account to actually get your money, and making sure security features like end-to-end encryption are on from day one. Getting this right from the start doesn’t just make checkout faster—it’s your first and best defense against fraud.

Setting Up Your Biyo POS for Seamless Payments

Before you ring up your first customer, you have to lay the proper groundwork in your Biyo POS. This isn’t a step you can afford to rush. The way you configure the system now will directly impact the speed, security, and overall reliability of every single transaction you process down the line. It’s about much more than just plugging things in; you’re building a secure payment environment for your business and your customers.

The choices you make during setup have real financial consequences. The merchant account you link determines your processing fees and how fast funds land in your bank. A system that’s been thrown together hastily can lead to declined cards, security holes, or checkout delays—all of which chip away at your profits and erode customer trust.

Connecting Hardware and Software Correctly

The first real step is creating the physical link between your card reader and the Biyo POS software. Make your life easier by ensuring your card reader is officially Biyo-compatible. Most modern readers will connect easily via Bluetooth or a simple USB cable, and the Biyo software does a good job of walking you through the pairing process.

Where I see people stumble is by not testing the connection properly. Once it’s paired, don’t just assume it works. Run a few test transactions. Use a chip card, tap a card, and even swipe one if your reader supports it. This little bit of due diligence confirms the hardware and software are communicating perfectly, saving you from an awkward moment in front of a real customer.

A secure and stable connection is the backbone of reliable payment processing. If the reader frequently disconnects or lags, it’s often a sign of a weak Bluetooth signal or a faulty cable, which should be addressed immediately to prevent service interruptions.

Before you start processing payments, it’s a good idea to run through a quick checklist. This helps ensure all the core components are in place and configured correctly, preventing headaches later on.

Biyo POS Initial Setup Checklist

| Setup Step | Configuration Detail | Why It Matters |

|---|---|---|

| Hardware Sync | Confirm the card reader is a Biyo-compatible model and successfully paired via Bluetooth or USB. | Prevents integration issues and ensures the terminal can physically read cards. |

| Merchant Account | Enter your Merchant ID (MID) and other credentials from your payment processor into Biyo’s settings. | This is the crucial link that directs funds from your customer’s bank to yours. |

| Security Protocols | Enable End-to-End Encryption (E2EE) and Tokenization within the payment settings. | Protects sensitive card data from the moment of transaction, which is key for PCI compliance and customer trust. |

| Test Transactions | Process several test sales using different payment methods (tap, chip, swipe). | Verifies that the entire system—hardware, software, and merchant account—is working together flawlessly. |

Going through these steps methodically will give you confidence that your payment system is ready for anything.

Configuring Your Merchant Account and Security

With your hardware connected, it’s time to shift your focus to the software side of things. This is where you’ll formally link your merchant account—the special type of bank account required to accept card payments. Inside the Biyo POS settings, you’ll need to enter the merchant ID and other credentials provided by your payment processor.

This is also your most important security checkpoint. Your top priority should be enabling all the features that support PCI DSS (Payment Card Industry Data Security Standard) compliance. There are two settings you absolutely need to activate:

- End-to-End Encryption (E2EE): This feature scrambles card data the instant the reader captures it and keeps it scrambled until it safely reaches the payment processor. This makes the information completely useless to anyone trying to intercept it.

- Tokenization: Instead of storing actual card numbers, this technology replaces them with a unique, meaningless “token.” This token can be used for things like recurring billing or refunds without ever exposing the real card details.

Getting this digital infrastructure right is more important than ever. The global market for credit card payments was valued at a massive USD 622.76 billion in 2024 and is on track to more than double by 2034. As payments evolve, so do the tools; if you’re exploring different platforms, you might find it interesting to read about Blockbee’s new web-based Point-of-Sale (POS) App. By taking these foundational steps seriously, you’re setting your business up to handle every transaction securely and efficiently.

Your Daily Guide to Credit Card Transactions

Okay, your Biyo POS system is all set up. Now for the fun part: actually taking payments. Getting a solid handle on your daily transaction workflow is what separates a clunky checkout from a smooth, professional one that keeps customers happy and the line moving. It’s not just about one type of payment, either—it’s about being ready for whatever comes your way.

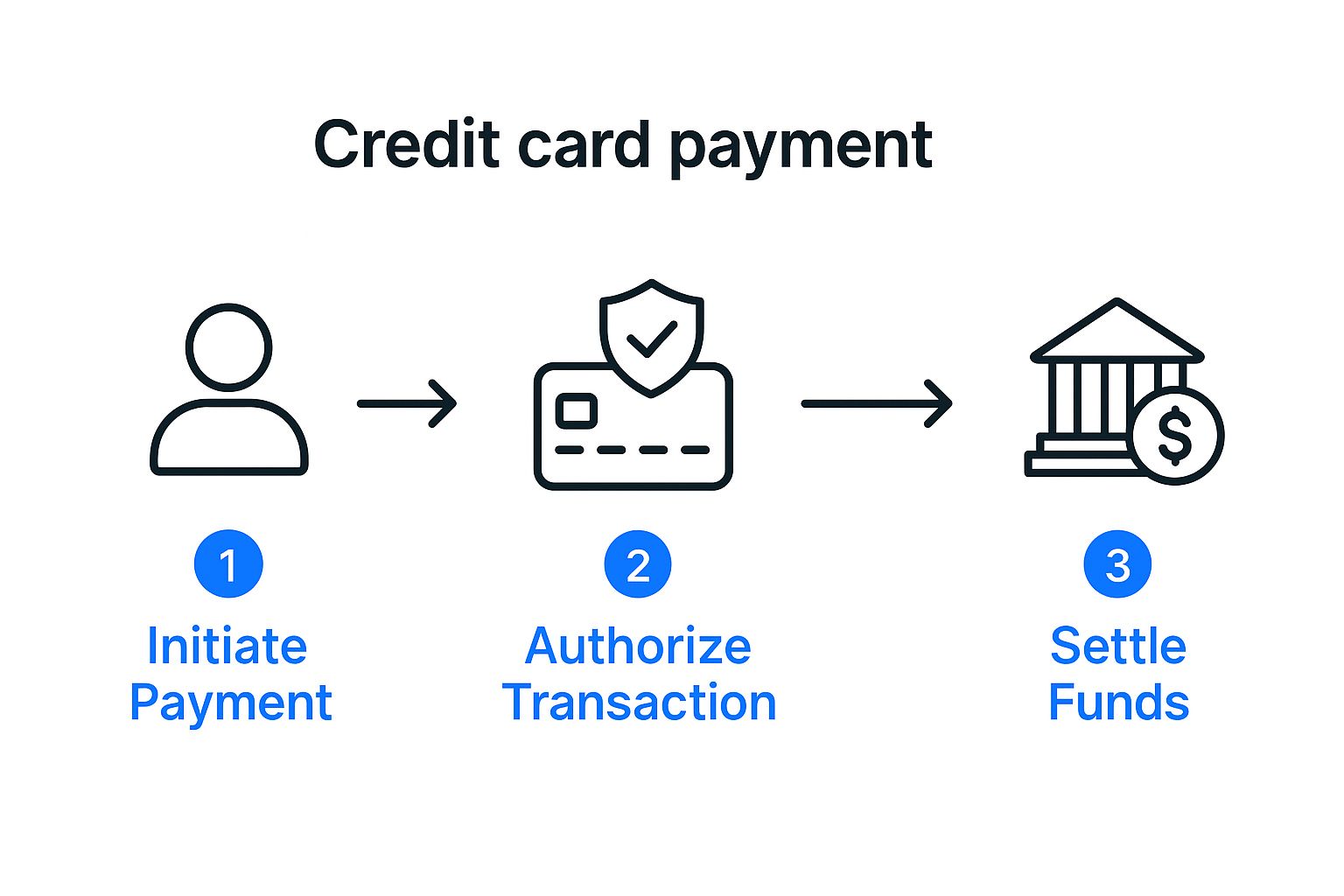

Whether it’s a traditional card swipe or a quick tap from a smartphone, every transaction pretty much follows the same basic path. Once you understand that flow, what’s happening behind the scenes becomes much clearer.

This simple breakdown shows the three stages every credit card payment goes through, from the moment a customer pays to when the money settles in your account.

Think of it as Biyo POS having a secure, instant conversation with the banks to authorize the funds and make sure you get paid. Let’s look at what that looks like in the real world.

Handling Common Payment Scenarios

Day-to-day, most of your transactions will be straightforward. Biyo POS is built to make these common interactions almost second nature.

- Tap-to-Pay (NFC): This is your speed champion. Customers just hold their card or phone (think Apple Pay or Google Pay) near the reader. The whole thing is usually approved in a couple of seconds, which is a lifesaver during a rush.

- Chip Cards (EMV): The customer pops their card into the reader and waits for the prompt. This has become the gold standard for in-person security, and it’s what most people are used to now.

- Swipe (Magstripe): You’ll see these less and less, but some cards still require a good old-fashioned swipe. Biyo POS handles them without a problem, but it’s always a good idea to gently nudge customers toward chip or tap for better security.

No matter the method, the Biyo POS screen gives you clear, real-time updates. You’ll see “Authorizing” and then “Approved,” so there’s no guesswork for you or the customer. After that, you can shoot them a digital receipt or print one out.

If you want to brush up on the fundamentals, we have a complete guide on how to take credit card payments that covers all the basics.

Managing Card-Not-Present Transactions

But what about that order someone calls in over the phone? Biyo POS has you covered with a “manual entry” option right on the payment screen. This lets you key in the customer’s card number, expiration date, and CVV code.

A quick but important tip: You’re handling incredibly sensitive information here. Never, ever write down a customer’s card details. Type them directly into the secure Biyo POS terminal. That way, the data is encrypted on the spot and kept safe from prying eyes.

This feature is a must-have for any business that takes deposits, phone orders, or any kind of remote payment. And let’s be real, this is becoming more common. In the U.S., credit card use has jumped from just 18% of payments in 2016 to the largest single share at 35% by 2024. Having a system that can reliably handle all types of card transactions isn’t just a convenience—it’s essential for modern business.

Handling Refunds, Voids, and Split Payments

Beyond a simple sale, the real test of your checkout process comes down to how you handle the exceptions. Anyone can ring up a basic purchase, but managing returns and complicated checkouts with confidence is what sets a great customer experience apart. Luckily, Biyo POS makes these scenarios pretty straightforward once you get the hang of it.

Getting these workflows right isn’t just about making customers happy, either. It’s about keeping your books clean. A botched refund or a clunky split payment can quickly turn into an accounting nightmare down the line, and it’s an easily avoidable headache.

Voids vs. Refunds: Knowing the Difference Saves You Money

One of the most common points of confusion is the difference between a void and a refund. They are absolutely not the same thing, and picking the right one has a direct impact on your bottom line.

Think of it this way: a void is like catching a typo in an email and deleting it before you hit send. A refund is like sending that email, waiting for the person to read it, and then asking them to delete it for you.

- Voiding a Transaction: You can only void a sale before you’ve batched out for the day. Since the money hasn’t actually been transferred from the customer’s bank yet, you’re simply cancelling the pending authorization. The charge usually vanishes from their statement within 24 hours, and the best part? No processing fees.

- Refunding a Transaction: This happens after the transaction has settled in your daily batch. You are physically sending money back to the customer’s card. The process can take a few business days to show up on their end, and you still have to eat the processing fee from the original sale.

Pro Tip: Always try to void a transaction if you catch a mistake the same day. For example, if a customer comes back just a few minutes later, check your transaction batch in Biyo first. Prioritizing voids can save you a surprising amount in processing fees over the course of a year.

How to Process Refunds and Split a Check

When a void isn’t an option, issuing a refund in Biyo POS is simple. Just pull up the original sale using the receipt number, date, or the last four digits of the credit card. You can then issue a full or partial refund right back to that card.

What if the customer doesn’t have the original card? To protect your business from potential fraud, the best practice is to offer store credit instead of cash.

Split payments are another daily occurrence. Let’s say a customer has a $75.30 bill and wants to put $50 on a gift card and the rest on their Visa.

- On the Biyo payment screen, tap the first payment type—in this case, Gift Card.

- Manually enter the amount they want to pay, which is $50.

- Process that payment first.

- Biyo will automatically calculate and display the remaining balance of $25.30.

- Now, just select the next payment method (Credit Card) to close out the sale.

Mastering this simple flow ensures every checkout is smooth and professional, no matter how they want to pay. It also keeps your sales records perfectly accurate by correctly attributing the funds to each payment source.

Protecting Your Business with Smart Security Practices

When you take a credit card payment, you’re handling more than just money—you’re responsible for your customer’s sensitive data. True security isn’t a one-time setup; it’s a daily practice. It’s about combining smart habits on your end with the powerful, automated protections Biyo POS runs behind the scenes.

This isn’t just about avoiding fraud and fines. It’s about building and keeping the trust of your customers. A single security slip can shatter that trust, so understanding your role is just as important as the technology you use.

https://www.youtube.com/embed/LV1id7bSyvc

How Biyo Keeps Your Transactions Safe

The bedrock of payment security is the Payment Card Industry Data Security Standard (PCI DSS). Think of it as the rulebook for any business that accepts credit cards. It can sound intimidating, but Biyo POS was built from the ground up to handle the heavy lifting for you.

Two of the most important security features working for you are tokenization and end-to-end encryption. They work in tandem to make stolen card data completely useless to a thief.

- End-to-End Encryption (E2EE): The second a card is tapped, dipped, or swiped, Biyo scrambles the data. It stays a jumbled mess until it reaches the payment processor’s secure servers. No one can intercept it in between.

- Tokenization: After that initial transaction, the real card number gets swapped out for a unique, random code—a “token.” If you need to issue a refund or look up a past sale, you’re only ever dealing with this safe token. The actual card number is never stored on your system.

These two features are your silent partners in every single transaction. They’re the core of how a modern POS system shields you from risk by getting the most sensitive data out of your hands and off your hardware.

If you want to get into the nitty-gritty, you can learn more about the specifics of https://biyopos.com/encyclopedia/pci-compliance/ and what it means for your business.

Training Your Team on Secure Habits

Your technology is only one part of the equation. Your staff forms a human firewall, and their daily actions are absolutely critical. A little consistent training on a few non-negotiable rules can make a massive difference in your security posture.

Everyone on your team needs to understand these practices and follow them every single time. For a wider look at protecting your business, check out these essential cyber security tips for small businesses.

To make it clear, let’s break down where your team’s responsibilities end and where Biyo’s automated systems take over.

Daily Security Checks vs System-Level Protections

Here’s a quick look at the security tasks you and your team handle versus the protections that Biyo POS automates for you.

| Security Measure | Your Responsibility (Daily Tasks) | Biyo POS Feature (Automated Protection) |

|---|---|---|

| Data Handling | Never write down or store credit card numbers on paper or in unsecured digital files. | Automatically uses tokenization to secure stored card data. |

| Transaction Monitoring | Visually inspect cards for signs of tampering; be wary of unusual or suspicious customer behavior. | Provides detailed transaction logs to review and flag irregularities. |

| Hardware Integrity | Regularly check card readers for skimmers or any physical damage that could compromise the device. | Employs End-to-End Encryption to protect data from the moment a card is used. |

When you pair these simple, daily habits with the robust, automated tools built into Biyo POS, you create a powerful, layered defense. It’s the most effective way to protect your business, your reputation, and your customers’ data.

Troubleshooting Common Payment Processing Issues

Even with the most reliable system, you’ll eventually hit a payment snag. A declined card or a frozen transaction can be a real headache, especially with a customer standing right in front of you. But don’t panic. Most of these issues are simple fixes you can handle on the spot, keeping your checkout line moving without a call to support.

Think of this as your first line of defense. Before you get flustered, take a breath and run through a quick mental checklist. Is the card reader actually on and connected? Is your internet connection stable? You’d be surprised how often these simple checks solve the problem in seconds.

Decoding Declined Cards and Connection Errors

That dreaded “Card Declined” message is by far the most common issue you’ll face. It’s crucial to remember this is rarely a problem with your Biyo POS system. The decline message comes directly from the customer’s bank, and it can mean a few different things.

- Insufficient Funds: This one’s pretty straightforward—the customer doesn’t have enough money in their account to cover the purchase.

- Incorrect Information: When you’re keying in a card manually, a simple typo in the card number, expiration date, or CVV will instantly trigger a decline.

- Fraud Protection: A customer’s bank might flag a transaction as unusual, especially if it’s a large purchase or they’re shopping somewhere new.

When a card gets declined, just politely and discreetly let the customer know. Suggest they try another card. Whatever you do, don’t try to run the same card multiple times; that’s a quick way to get it locked by their bank.

Another frequent hiccup is a card reader that just won’t connect. This is almost always a local hardware or network issue on your end.

Pro Tip: First, try the classic “turn it off and on again.” A quick reset of the reader often works wonders. Next, pop into your device’s Bluetooth settings and make sure it’s still paired with your Biyo terminal. If it’s still giving you trouble, a weak Wi-Fi signal is the most likely culprit.

Resolving Frozen Transactions and Error Codes

Ever seen a transaction that seems stuck on “Authorizing” forever? That’s usually a classic symptom of an unstable internet connection. Your system is trying its best to talk to the payment processor but just can’t get a clear signal through. The first thing you should do is check your router and Wi-Fi connection.

If Biyo POS ever throws a specific error code at you, don’t just dismiss it. These codes are valuable clues. Jot down the code and look it up in Biyo’s support documentation. It will often point you to the exact problem, like a misconfigured setting in your merchant account or even a temporary outage with the payment processor.

With over 631 million active credit card accounts in the US alone, the payment infrastructure is massive, and occasional network blips are just part of the game. You can learn more about the latest credit card statistics to get a sense of the scale. By tackling these common problems with a clear head, you can solve them fast and keep the checkout experience smooth for every single customer.

Common Questions About Biyo POS Payments

Even with a system as intuitive as Biyo POS, questions are bound to pop up. When you’re in the middle of a busy day, you need clear, quick answers to handle any payment situation that comes your way.

Here are some of the most frequent questions we get from business owners just like you. Think of this as your go-to guide for navigating those real-world payment scenarios with confidence.

How Quickly Do Funds Appear in My Bank Account?

This is almost always the first thing people ask, and for good reason—cash flow is king. Generally, you can expect the money from your credit card sales to hit your bank account within 1 to 3 business days.

The exact timing really depends on your merchant services provider and when you “batch out” or close your daily transactions. Biyo POS makes it easy to track this with detailed batch reports, but for the most precise deposit schedule, your merchant agreement is the ultimate source of truth.

What Happens if My Internet Goes Down?

Losing your internet connection during a rush is a nightmare scenario for any business owner. Thankfully, Biyo POS has you covered with its built-in ‘Offline Mode’.

You’ll want to enable this feature in your settings ahead of time. When active, it lets you keep swiping and accepting cards by securely storing the transaction data right on your device. As soon as your connection comes back, Biyo POS automatically pushes all those queued payments through. It’s a real lifesaver.

It’s important to remember that while Offline Mode is active, you can’t get real-time card authorizations. This introduces a small risk that a card might be declined once you’re back online, but it’s a fantastic tool for keeping business moving.

What Is a Chargeback and How Do I Handle It?

A chargeback happens when a customer disputes a charge with their bank, which then reverses the transaction. It’s not just a refund; it’s a formal dispute that you need to respond to. You’ll get a notification from your payment processor when one is initiated.

Biyo POS gives you instant access to all the original transaction details—the receipt, items sold, and the exact timestamp. This is the evidence you’ll need to fight the chargeback. Responding quickly with proof that the sale was valid is your best shot at winning the dispute and protecting your hard-earned revenue.

Are All Credit Card Processing Fees the Same?

Not at all. The fees you pay can change from one transaction to the next, and it all comes down to risk.

- Card-Present Transactions: When a customer physically taps, dips, or swipes their card, it’s the most secure method. These transactions always have the lowest processing rates.

- Card-Not-Present Transactions: Keying in a card number manually for a phone order is considered higher risk, so the fees are naturally higher.

- Card Type: The card itself also plays a big role. A basic debit card is much cheaper to process than a high-end corporate rewards card.

Getting a handle on these factors is crucial for managing your costs. If you want to dig deeper, you can learn more about finding cheap credit card processing with Biyo and keeping more of your money.