Ever get that nagging feeling that your inventory numbers just don't add up? You look at your records, and they say you have 100 units of a best-selling item. But when you go to the stockroom, you can only find 95. That missing five? That's inventory shrinkage in a nutshell.

It’s the gap between the stock you think you have on your books and the physical stock you can actually touch and count. This isn't just a minor accounting hiccup; it's a direct hit to your profitability.

What Is Inventory Shrinkage Explained Simply

Think of your inventory like a big bucket of water. You fill it up with new stock (adding water) and sell products to customers (taking water out). But what if you notice the water level is dropping a little faster than it should? You’ve probably got a leak.

In the retail and hospitality world, inventory shrinkage is that slow, costly leak.

It’s the value of all the products that disappear before they can ever be sold. We're not just talking about one or two misplaced items. Industry reports show that inventory shrinkage costs retailers an average of 1.6% of their total sales every year. That might not sound like much, but for many businesses, it’s the difference between a profitable year and a loss.

Getting a handle on this concept is the first crucial step toward plugging those leaks and protecting your hard-earned assets.

The Four Main Leaks in Your Inventory Bucket

Shrinkage is rarely caused by a single issue. Instead, it’s usually a combination of problems that slowly but surely eat away at your stock. These losses almost always fall into one of four categories.

Shrinkage is a silent profit killer. It happens when the inventory logged in your system doesn't line up with what’s physically on your shelves, creating lost revenue, operational chaos, and higher costs for everyone.

To fight shrinkage, you have to know where it's coming from. Every product you carry is tracked with a unique code, and a solid understanding of the stock-keeping unit (SKU) is essential for keeping things in order. When an item with a specific SKU vanishes without being sold, you've got shrinkage.

Let's break down the four main culprits.

The Four Main Causes Of Inventory Shrinkage

Here’s a quick overview of the primary reasons inventory goes missing, along with some common, real-world examples you might recognize.

| Cause of Shrinkage | Description | Common Examples |

|---|---|---|

| Theft & Fraud | Unauthorized removal of goods by customers (shoplifting) or employees (internal theft). | A customer slipping an item into their bag. An employee taking products home or voiding a friend's transaction at the register. |

| Administrative Errors | Simple human mistakes made during paperwork, data entry, pricing, or stock counts. | Miscounting a new shipment, entering the wrong quantity into the system, or pricing an item incorrectly at checkout. |

| Vendor Fraud | Discrepancies caused by your suppliers, whether it's an honest mistake or intentional. | A vendor invoices you for 50 cases but only delivers 48. Receiving a shipment with items that don't match the purchase order. |

| Damage & Spoilage | Products that become unsellable due to accidents, poor handling, or simply expiring. | A box of glass bottles is dropped and broken. Fresh produce goes bad before it can be sold. Electronics are damaged in the warehouse. |

Recognizing these "leaks" is the foundation for building a strategy to stop them. Once you know what you're up against, you can start taking targeted action.

The True Financial Cost of Disappearing Stock

It’s easy to think of inventory shrinkage as just a few missing items from the shelf, but it’s far more sinister. Think of it as a direct hit to your business's financial health. Each lost product triggers a chain reaction of financial problems that can spread through your entire operation, starting right with your bottom line.

When a product vanishes, you don't just lose the future sale. You also lose every dollar you spent to buy, store, and manage it in the first place. This double whammy—lost investment and lost revenue—is what makes shrinkage such a serious threat.

These "small" losses add up faster than you'd think, becoming a significant and often invisible drain on your profits.

Your Profit Margins Are Disappearing, Too

Your profit margin is the reward you earn on every sale. When stock goes missing, it eats directly into that reward. Every item that disappears inflates your Cost of Goods Sold (COGS) but brings in zero revenue to balance it out.

Essentially, your books show you paid for an item that was never sold. This imbalance makes your COGS look higher than it should be, which in turn shrinks your gross profit.

It's a subtle but powerful effect. A business might look busy and successful on the surface, but if inventory is consistently vanishing behind the scenes, the real profitability is much lower than the numbers suggest.

"A small leak will sink a great ship." This old saying is the perfect analogy for inventory shrinkage. A seemingly minor 1% or 2% shrinkage rate can be the difference between a profitable quarter and a major loss, quietly chipping away at your financial stability.

Over time, this steady drain can cause serious cash flow issues and stop you from investing in the growth of your business.

It Skews Your Financial Reporting

One of the most dangerous side effects of uncontrolled shrinkage is the mess it makes of your financial statements. When your inventory records are wrong, key reports like your balance sheet and income statement become unreliable. You're flying blind.

An inflated inventory value on your balance sheet gives a false sense of security, making your company’s assets look more valuable than they are. This can mislead investors, lenders, and even you about the true financial state of your business.

Likewise, a bloated COGS on your income statement will understate your net income, which can lead to poor strategic decisions based on faulty data. To get a real grip on this, it's crucial to understand how to read Profit and Loss statements and see how these losses are reflected.

This Is a Billion-Dollar Problem

The scale of this issue is staggering. According to the National Retail Federation (NRF), inventory shrinkage in the U.S. climbed to 1.6% in 2022, up from 1.4% the previous year. A 0.2% jump might not sound like much, but it represents billions of dollars in losses for retailers.

And this isn't just a headache for big-box stores. For a small business with $500,000 in annual sales, a 1.6% shrinkage rate means $8,000 in lost profit every single year.

Think about what that $8,000 could have been used for:

- New marketing campaigns to bring in more customers.

- Hiring another employee to improve customer service.

- Investing in new equipment to make your operations more efficient.

At the end of the day, shrinkage isn't just an operational nuisance—it's a critical financial risk. Tackling it head-on is essential to protect your assets, maintain accurate financial records, and ensure your business stays healthy for the long run.

Understanding Where Your Inventory Is Going

To stop inventory from vanishing, you first have to figure out where it’s going. Think of yourself as a detective on a case—you need to identify the culprits responsible for your disappearing stock. The trail almost always leads back to one of four key areas, and each one exposes a different weak spot in your operations.

Pinpointing these sources is the first real step toward building a defense that actually protects your bottom line. Let's break down each one.

External Theft: The Classic Shoplifter

When most of us hear "inventory shrinkage," we immediately picture a shoplifter. This is external theft—the most obvious cause of loss, where people who aren't on your payroll walk out with products they didn't pay for.

The methods vary wildly. Sometimes it’s a simple crime of opportunity, like someone slipping a small item into their pocket. Other times, it's a far more sophisticated operation run by organized retail crime (ORC) rings. These groups systematically target high-value items that are easy to resell, often hitting multiple stores and causing a ton of financial damage in a very short time.

Shoplifting isn't just a minor annoyance; it's a massive driver of loss. It's responsible for more than a third of all inventory shrinkage, making it a constant and expensive headache for businesses of every size.

While you can never eliminate it completely, you can certainly put up a good fight. Understanding your customers' behavior, how your store is laid out, and which products are most at risk will help you put effective deterrents in place.

Internal Theft: When the Threat Is on Your Payroll

External theft might grab all the headlines, but internal or employee theft is often a much more damaging and sneaky problem. Your employees have trusted access to both your products and your cash, giving them far more opportunities to steal—and making it much harder to detect.

This kind of shrinkage shows up in a few different ways:

- Direct Product Theft: An employee simply takes merchandise home without paying.

- Discount Abuse: Staff give unauthorized discounts to their friends or family.

- Fraudulent Returns: An employee processes a fake return and pockets the cash.

- "Sweethearting": A classic move where a cashier intentionally doesn't scan an item for a customer they know.

These actions don’t just hit your inventory; they create a culture of distrust and can seriously tank team morale.

Administrative Errors: The Silent Culprit

Not all shrinkage comes from bad intentions. A huge chunk of it is the result of simple human mistakes, often called administrative or clerical errors. These are the "paperwork" problems that create a gap between the inventory you think you have in your records and the stock you actually have on your shelves.

It’s like a series of small miscalculations that eventually snowball into a major discrepancy. These slip-ups can happen at any stage of the inventory journey.

Common Administrative Errors Include:

- Receiving Mistakes: A new shipment arrives, but it’s counted incorrectly.

- Pricing Errors: An item is priced wrong in the system, messing up your sales data.

- Data Entry Flaws: An employee meant to type "10" but accidentally entered "100" when updating stock levels.

- Misplaced Items: Products get shelved in the wrong spot and are assumed to be lost.

Individually, these mistakes seem minor. But together, they create total chaos in your inventory data, making it impossible to know what you truly have on hand.

Vendor Fraud and Product Damage

Finally, some shrinkage happens before products even have a chance to hit your sales floor. Vendor fraud is what happens when a supplier either makes an honest mistake or intentionally shorts you on a delivery. For example, they might bill you for 10 cases of a product but only ship nine—a difference that’s easy to miss if you don’t have strict receiving procedures.

On top of that, you have damage and spoilage. Items can get broken during shipping, get mishandled in the stockroom, or simply expire before they can be sold. For any business dealing with perishable goods like food or pharmaceuticals, spoilage is a primary cause of shrinkage. These unsellable items have to be written off, which contributes directly to your overall loss.

When you add it all up, these issues are a massive global challenge. According to one study, the worldwide shrinkage rate hovers around 1.82% of annual retail sales. That translates into nearly $100 billion in losses every single year. The fashion and accessories industry often gets hit the hardest, which just goes to show how vulnerable certain businesses are to these different sources of loss. You can find more insights about the global impact in the Sensormatic Global Shrink Index.

By taking a hard look at each of these four categories, you can move from just knowing what shrinkage is to truly understanding how and where it’s hurting your business.

How to Accurately Calculate Your Shrinkage Rate

You can't fix a problem you can't measure. So, before you can start plugging the leaks in your inventory, you need a clear picture of exactly how much you’re losing. Calculating your inventory shrinkage rate turns that vague sense of loss into a hard number—a metric you can track, analyze, and ultimately, improve.

Think of this number as your baseline. It's the starting point that lets you see if any new loss prevention strategies are actually working. This is how you move from just knowing what shrinkage is to actively fighting back against it.

The Shrinkage Rate Formula

Figuring out your shrinkage rate is more straightforward than you might think. It’s all about comparing the value of the inventory you should have on your books with the value of the inventory you actually have after a physical count.

Here’s the simple formula:

Shrinkage Rate = (Recorded Inventory Value – Actual Inventory Value) / Recorded Inventory Value

The answer is a percentage telling you how much of your inventory’s value has simply vanished. For instance, if your records show $100,000 worth of inventory but a physical count reveals you only have $98,000, your shrinkage rate is 2%.

That 2% represents $2,000 in lost assets and potential sales. So, how do you find the numbers to plug into this formula? Let's walk through it.

Step 1: Gather Your Inventory Records

First things first, you need to find your recorded inventory value. This is the dollar value of all the stock your system believes you have on hand at a given moment. You'll pull this data straight from your inventory management software or Point of Sale (POS) system.

This figure is built from your records of:

- Purchases and shipments received from suppliers.

- All sales made to customers.

- Any returns or exchanges processed.

- Known losses, like items you've officially written off as damaged or expired.

The reliability of this number hinges entirely on how clean your data is. The method you use to assign value to each item also plays a huge role, which is why a solid grasp of your chosen inventory costing method is essential for accurate financial reporting.

Step 2: Conduct a Physical Inventory Count

Next up is determining the actual inventory value. There’s no shortcut here—this requires a hands-on count of every single item you have, both in the stockroom and on the sales floor. It's often the most tedious part of the process, but it's non-negotiable for accuracy.

Once you have a physical count for every product, you'll multiply that number by its cost to find the total value. That final sum is your true, on-hand inventory value.

Step 3: Calculate and Analyze

With both values ready, you can pop them into the formula. The result is your shrinkage rate for the period since your last physical count.

But don't just stop there. The real magic happens when you analyze the result. Is your rate higher or lower than the typical industry average of 1% to 2%? Is it creeping up or trending down compared to your last count?

A surprisingly high shrinkage rate could point to a serious theft problem. On the other hand, a rate that’s slowly ticking upward might signal growing issues with supplier errors or administrative sloppiness. Use this data as a diagnostic tool to find the weak spots in your operation. By making this calculation a regular habit, you give your business the power to make smarter, data-driven decisions that protect your profits.

Proven Strategies to Reduce and Prevent Shrinkage

Knowing what inventory shrinkage is and how to calculate it is a great start, but it's only half the battle. Now, it’s time to put that knowledge into practice. A proactive loss prevention plan is your best defense against stock that seems to vanish into thin air, combining the right tech, solid processes, and engaged people to shield your assets.

This isn't about finding a single magic bullet. It’s about building a robust system where every part supports the others. By plugging the leaks at every level of your business, you can systematically cut your losses and protect your profits.

Fortify Your Operations With Technology

Modern technology is your first line of defense, acting as a tireless, data-driven guard for your inventory. These tools work 24/7 to track products, monitor what’s happening, and flag strange activity long before it snowballs into a major problem.

- Modern Point of Sale (POS) Systems: Think of your POS as more than just a cash register—it's the command center for your inventory. A powerful system like Biyo gives you real-time tracking for every sale, return, and stock adjustment. This creates a precise digital paper trail that slashes the risk of simple administrative errors.

- CCTV Surveillance: A few strategically placed security cameras can be a massive deterrent to both external and internal theft. Visible cameras in high-risk spots—like entrances, cash registers, and back rooms—make would-be thieves think twice and give you crucial evidence if something does happen.

- Data Analytics: Your sales and inventory data are telling a story, if you know how to read it. By digging into this information, you can spot unusual patterns, like a suspicious number of voided sales at one register or a specific item that goes missing way too often.

These tech tools are fantastic, but they become exponentially more effective when you back them up with solid, day-to-day procedures.

Implement Bulletproof Processes

Strong, consistent processes are the backbone of any successful loss prevention strategy. They create a predictable, accountable environment where mistakes and theft have nowhere to hide. You'd be surprised how much of an impact a few small procedural tweaks can have on your shrinkage rate.

To get a real handle on shrinkage, you need to implement strong inventory management. It’s worth exploring essential inventory management best practices that can make a huge difference in your losses.

Here are a few key processes to lock down:

- Conduct Regular Inventory Audits: Don't wait until the end of the year to discover a huge problem. Start using cycle counting—counting small sections of your inventory on a rolling schedule. This keeps your records accurate all year long and helps you spot discrepancies almost as soon as they happen.

- Establish Secure Receiving Protocols: The receiving dock is where most administrative errors and vendor fraud occur. Make it a rule that at least two employees must check every incoming shipment against the purchase order before it gets entered into your system. No exceptions.

- Optimize Your Store Layout: Design your floor plan to eliminate blind spots. Keep small, high-value items that are easy to pocket in locked cases or right by the checkout counter. A well-lit, open layout makes it much harder for shoplifters to go unnoticed.

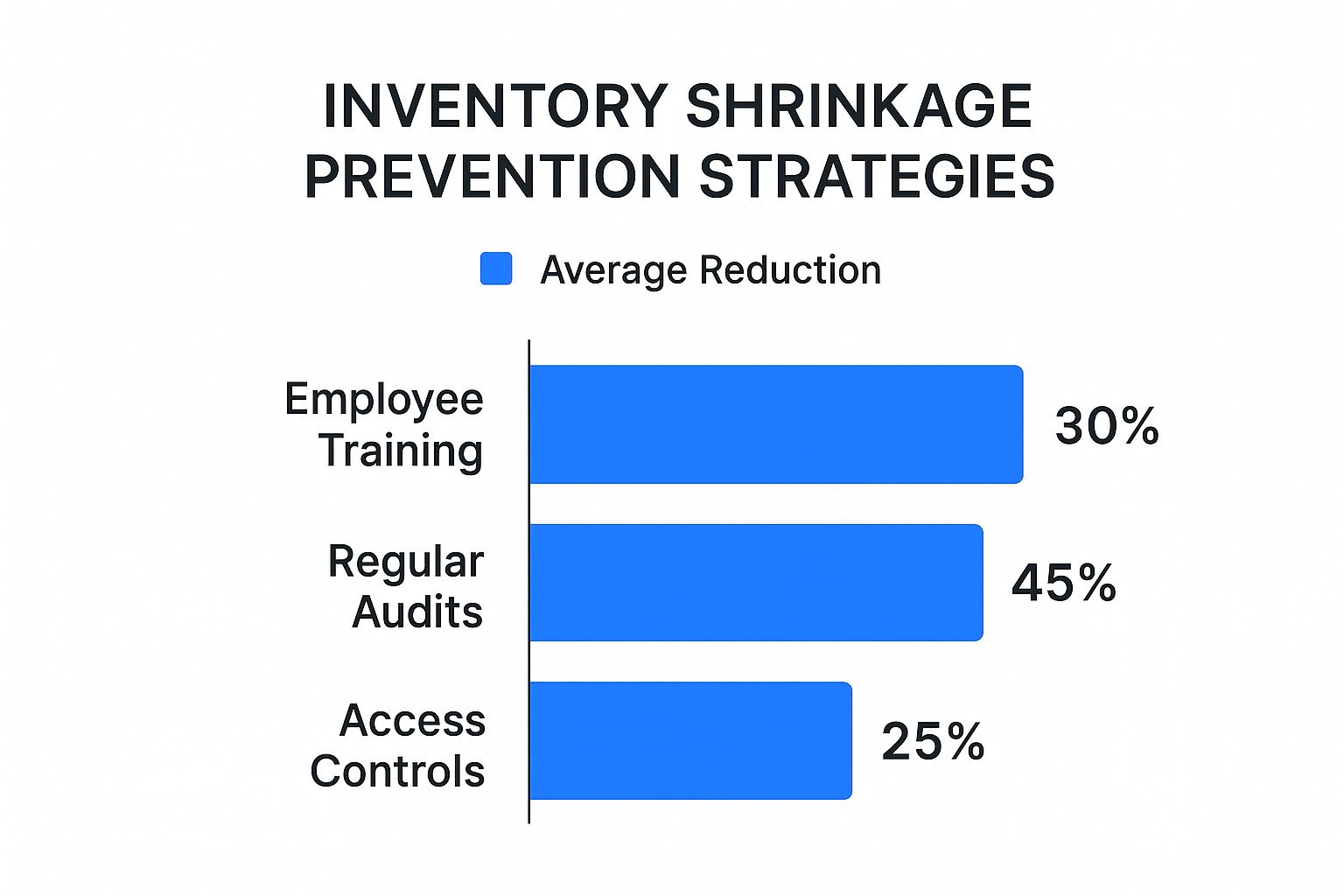

This chart breaks down how much different prevention strategies can reduce shrinkage, and you'll notice how big of an impact process improvements like regular audits can have.

As you can see, simply conducting regular audits can cut shrinkage by nearly half. That makes it one of the most powerful, process-based tools you have.

Comparing Inventory Shrinkage Prevention Methods

Not all prevention strategies are created equal. Some are quick wins, while others are long-term investments. This table breaks down some of the most common methods to help you decide which ones are the right fit for your business.

| Prevention Method | Primary Target | Estimated Cost | Effectiveness |

|---|---|---|---|

| CCTV Surveillance | Shoplifting, Employee Theft | Moderate-High | High deterrent value, useful for investigations. |

| POS System Auditing | Admin Errors, Employee Theft | Low-Moderate | Very high; catches discrepancies in real-time. |

| Cycle Counting | Admin Errors, Damaged Goods, Theft | Low (Time) | High; maintains constant accuracy and spots issues early. |

| Employee Training | All Forms of Shrinkage | Low-Moderate | High; creates an accountable and vigilant culture. |

| Secure Receiving | Vendor Fraud, Admin Errors, Damage | Low (Time) | High; prevents losses before stock hits the floor. |

| Optimized Store Layout | Shoplifting | Low-High | Moderate; reduces opportunities for external theft. |

The key takeaway here is that a balanced approach is best. Combining low-cost, high-impact process changes like cycle counting with smart technology investments gives you the most comprehensive protection.

Invest In Your People

At the end of the day, your employees can either be your biggest vulnerability or your greatest asset in the fight against shrinkage. It all comes down to fostering a culture of ownership and accountability. That journey starts with hiring the right people and giving them the training and trust they need to do the right thing.

An engaged and well-trained team is your most effective deterrent. When employees feel valued and understand their role in protecting the business's assets, they become active participants in loss prevention rather than passive bystanders.

Here’s how to build a team that actively protects your inventory:

- Thorough Hiring and Screening: Don't rush the hiring process. Take the time to conduct background checks and actually call those references, especially for roles that involve handling cash or high-value stock.

- Comprehensive Employee Training: From day one, educate your staff on what shrinkage is and how it directly impacts the health of the business (and, by extension, their job security). Train them on the right way to do everything, from receiving inventory and processing returns to spotting suspicious customer behavior.

- Foster a Culture of Accountability: Be crystal clear about your policies on internal theft and make sure everyone is held to the same standard. When people see that the rules are enforced fairly, it builds trust and discourages bad behavior.

The scale of this problem is staggering. Inventory distortion, which includes shrinkage, contributes to $1.7 trillion in losses for retailers globally, with out-of-stocks alone accounting for a mind-boggling $690.9 billion. These aren't just numbers; they point to deep-rooted issues in how businesses manage their supply chains. To fight back, companies are embracing technology that can sharpen their inventory accuracy to over 95%. This doesn't just cut losses—it builds a much more resilient and profitable business.

Ultimately, a multi-layered defense combining technology, processes, and people is what truly works. To see how all these pieces fit together, it helps to understand what is inventory management software and how it can act as the central nervous system for your entire loss prevention strategy. By integrating these strategies, you can shift from just reacting to problems to proactively protecting your business.

Common Questions About Inventory Shrinkage

Even when you've got a handle on the basics, a few practical questions about inventory shrinkage always pop up. Getting straight answers to these is the key to moving from just knowing what shrinkage is to actually doing something about it. Let's tackle some of the most common questions business owners ask.

What Is an Acceptable Level of Inventory Shrinkage?

Look, the dream is always zero shrinkage, but in the real world, that's just not going to happen. For most retail businesses, an "acceptable" rate lands somewhere between 1% and 2% of total sales.

But that's just a general benchmark. What’s acceptable for you really depends on your industry. A grocery store will naturally have a higher shrinkage rate from spoiled produce than a hardware store selling nuts and bolts. The most important thing is to know your number and work to make it better each year.

How Often Should I Conduct a Physical Inventory Count?

This really comes down to the size and nature of your business. Big-box retailers often do a massive, wall-to-wall count only once or twice a year simply because it’s a huge, disruptive process that forces them to shut down.

A much better approach for most businesses is cycle counting. Instead of doing it all at once, you count small, manageable sections of your inventory every day or week. This keeps your records accurate year-round and lets you spot problems almost as soon as they start, all without closing your doors.

Can a Good POS System Really Help Reduce Shrinkage?

Absolutely. A modern Point of Sale (POS) system is probably the single best weapon you have in the fight against shrinkage. It gives you a real-time view of your inventory, instantly showing you the difference between what the system says you should have and what's actually been sold.

Think about it: by tracking every sale, return, and discount, a solid POS cuts down on simple human error and makes internal theft much harder to pull off. The data it provides is gold. You can easily spot weird patterns—like one register having way more voided sales than others—which can be a red flag for a bigger issue.

What Is the Difference Between Shrinkage and Spoilage?

This is a great question, and it's easy to get them mixed up. The simplest way to remember the difference is this: spoilage is just one reason for shrinkage.

Shrinkage is the big-picture term for any inventory you lose for any reason—theft, damage, supplier mistakes, or paperwork errors. Spoilage, on the other hand, is very specific: it’s inventory that can't be sold because it expired or went bad.

So, a rotten head of lettuce is spoilage (and therefore also shrinkage). A stolen t-shirt is shrinkage, but it's not spoilage. For a café, spoilage is a huge piece of the shrinkage puzzle; for a bookstore, it’s not a factor at all.

Ready to stop losses and gain full control over your stock? Biyo offers a powerful, all-in-one POS system with real-time inventory management designed to slash shrinkage and boost your bottom line. Discover how Biyo can protect your profits today.