Ever wondered what’s really going on behind the counter when you tap your card to buy a coffee? That simple, quick action is the final step in a sophisticated process managed by a Point of Sale (POS) system.

It's so much more than a modern cash register. A good POS is the central nervous system for a retail shop, a bustling cafe, or any service-based business.

Your Quick Guide to Point of Sale Systems

Think of a POS system like the air traffic controller at a busy airport. It manages every incoming and outgoing flight (transaction), communicates with the pilots (payment processors), keeps track of which gates are open (inventory), and ensures everything runs on schedule and without a hitch.

In much the same way, a POS system coordinates the moving parts of a sale—from the moment a customer decides to buy, to the money landing in your bank account. To get a handle on the fundamentals, our guide on what is a point of sale system is a great place to start.

The Transaction Journey Explained

So, what does a transaction actually look like from the system's point of view? Let’s follow the path of a single purchase.

It all starts when a customer brings their chosen items to the checkout. The cashier scans the barcode, and the POS software instantly pulls the product's price and information from the database, adding it to the customer's bill. After scanning all items, the system totals everything up, automatically applying any relevant taxes or discounts.

Next, the customer decides how to pay—whether with a credit card, a mobile wallet like Apple Pay, or good old-fashioned cash. The POS system securely connects to a payment processor to get the transaction authorized, which usually takes just a couple of seconds.

Once the green light for the payment is given, the system finalizes the sale. It then prints or emails a receipt, and here’s the crucial part: it automatically updates your inventory levels in real time. This single step is what prevents you from selling an item you don’t have and feeds critical data into your sales reports.

Breaking Down the Process

To really see how it all connects, let’s look at the four distinct stages that make up a modern POS transaction. This isn't just a simple swipe-and-go; it's a sequence of events where your hardware and software work together perfectly.

The table below breaks down exactly what's happening at each step of the journey, showing how different components team up to make the sale happen smoothly.

The Four Stages of a Modern POS Transaction

A breakdown of the key steps involved when a customer makes a purchase using a point of sale system, from initial sale to final settlement.

| Stage | What Happens | Key Components Involved |

|---|---|---|

| 1. Sale Initiation | A customer brings items to the counter to purchase. The cashier scans the product barcodes. | Barcode Scanner, POS Terminal, POS Software |

| 2. Payment Collection | The POS calculates the total amount, and the customer presents their payment method. | POS Software, Card Reader, Cash Drawer |

| 3. Transaction Authorization | The system securely sends payment details to the payment processor and bank for approval. | Card Reader, Payment Processor, Issuing Bank |

| 4. Sale Finalization | Payment is approved, a receipt is generated, and inventory and sales data are updated automatically. | Receipt Printer, POS Software, Inventory Database |

Each stage flows seamlessly into the next, creating a fast and reliable experience for both the customer and your staff. It’s this behind-the-scenes dance of technology that keeps a modern business running efficiently.

Deconstructing POS Hardware: The Physical Components

If the POS software is the brain of your operation, the hardware is the body—the hands, eyes, and ears that interact with the physical world. These are the tools you and your staff use every day to take orders, process payments, and ring up sales. Think of it like assembling a custom toolkit; the specific tools you choose depend entirely on your business, whether you're running a high-volume retail store or a pop-up coffee stand.

To really understand how a point of sale works, you have to see how these physical devices talk to the software. Each piece has a very specific job, translating a customer's decision to buy into a secure, completed transaction in your system. This plug-and-play nature is one of the best things about modern systems like Biyo POS, letting you build a setup that fits your workflow perfectly.

The Central POS Terminal

At the center of it all is the POS terminal. This is the command hub, the primary screen where your staff rings up sales, looks up inventory, and manages customer orders. Gone are the days of bulky, beige cash registers. Today’s terminals are much more versatile.

You might see anything from a traditional desktop computer to a sleek iPad or even a smartphone for businesses on the move. A busy boutique might want a sturdy countertop terminal that can handle a constant flow of customers. In contrast, a restaurant server gains a huge advantage with a tablet they can carry right to the table for faster service. This device is the brain of the hardware, coordinating all the other pieces.

Essential Transaction Peripherals

While the terminal runs the show, it relies on a team of supporting devices—known as peripherals—to get the job done. Each one connects to the terminal, either with a physical cable or wirelessly via Bluetooth, and waits for its cue to act.

Here are the most common players you'll find at a checkout counter:

- Credit Card Reader: In today's economy, this is non-negotiable. It’s the device that securely captures payment data from credit cards, debit cards, and digital wallets. Modern readers are equipped for everything: chip cards (EMV), the old-school magnetic stripe, and contactless payments (NFC) like Apple Pay or Google Pay.

- Barcode Scanner: A massive time-saver for any retail business. It instantly reads a product's barcode (the UPC) and zaps that information straight to the POS. The software then pulls up the correct item and price, which drastically cuts down on manual entry mistakes and keeps the checkout line moving.

- Receipt Printer: Digital receipts are popular, but many customers still want a physical copy. Thermal printers are the industry standard because they're fast, quiet, and don't use ink. In a restaurant, you might have a second printer in the kitchen that automatically prints new orders for the cooks.

- Cash Drawer: For any business that handles cash, this is a must. It's a heavy-duty, lockable drawer that connects directly to the terminal. It's programmed to pop open only when a cash sale is processed, which keeps money secure and makes cashing out at the end of the day much simpler.

The magic of POS hardware is how it all works together. A cashier scans a barcode, and the item appears on the terminal. The customer taps their card, and the reader processes the payment. Once the sale is final, the cash drawer opens and the printer spits out a receipt. It's a beautifully synchronized dance designed for pure efficiency.

This entire ecosystem of devices works in perfect harmony to make every single transaction feel smooth and effortless. By picking the right combination of hardware, you can build a point of sale that not only works but works for you, giving you the right tools to serve your customers and grow your business.

Inside the POS Software: The Brains of Your Business

If the hardware is the body of your checkout counter, the POS software is its brain. It’s the powerful, unseen force that turns a bunch of separate devices into a single, intelligent machine that actually runs your business. Think of it as the central nervous system, taking in information from every transaction and making sure the entire operation hums along smoothly.

Modern software is so much more than a digital cash register. It’s the engine driving everything from your inventory levels to your customer loyalty programs. To really understand how a point of sale system works, you have to get to know the software.

Seamless Transaction Processing

First and foremost, the software has to make every sale quick, correct, and completely painless. When a cashier scans a product, the software instantly finds it in the database, pulls up the right price, and adds it to the order. It also effortlessly handles the tricky stuff, like applying discounts, calculating sales tax, and accepting different payment methods.

This isn't just about speed; it's about accuracy. The software ensures every single sale is recorded correctly, creating a reliable foundation for all your other business decisions. This precision is what prevents costly mistakes and gives you a crystal-clear picture of your daily performance.

Real-Time Inventory Management

Here’s where POS software truly starts to flex its muscles: real-time inventory management. Picture running a busy clothing boutique. A customer buys that last medium-sized blue dress. The moment that sale goes through, the software automatically subtracts that exact item from your stock count.

That instant update is a total game-changer. It means your inventory data is always accurate, which helps you avoid the dreaded situation of selling something you don't actually have. Advanced systems like Biyo POS can even be set up to send you an alert when stock gets low, so you can reorder before you’re completely out. This feature alone can help a business boost its stock accuracy by as much as 99%.

This automated tracking gives you a few massive advantages:

- No More Stockouts: You can stop disappointing customers and losing sales because an item isn't on the shelf.

- Less Overstocking: With clear data on what's selling (and what's not), you can stop tying up your cash in products that just sit there.

- Huge Time Savings: Forget tedious, manual stock counts. You and your team can focus on more important things.

In essence, the software gives you a live, bird's-eye view of your entire product catalog. You know exactly what you have, where it is, and when to order more, all from a single screen.

Powerful Customer and Employee Management

A great POS system also helps you build stronger relationships and manage your team more effectively. It keeps a log of every customer's purchase history, creating detailed profiles you can use for targeted marketing and loyalty programs. You can easily spot your best customers and reward them with special offers to keep them coming back.

For instance, a coffee shop owner could check their POS data, see which customers buy a caramel latte every morning, and send them a targeted "buy one, get one free" coupon. That kind of personal touch is what turns a casual visitor into a loyal regular.

On the staff side, the software tracks employee sales performance and hours worked. You can identify your top performers, build schedules, and make payroll a whole lot simpler. It gives you the concrete data you need to train your team and recognize their hard work.

The Rise of Cloud-Based Systems

These days, the most powerful POS software is cloud-based. This just means that all your business data—sales, inventory, customer info—is stored securely online instead of on a clunky server in your back office. This simple shift gives you incredible flexibility. You can access your business dashboard from anywhere, at any time, on any device with an internet connection.

Cloud systems also take care of software updates automatically, so you always have the latest features and security without lifting a finger. This remote access and hands-off maintenance are at the core of how modern point of sale systems work, giving owners the freedom and insight to manage their business from anywhere.

How Your Point of Sale System Processes Payments

That two-second tap of a credit card at your counter? It kicks off a complex, high-speed journey that most customers never see. While it feels instant, a digital chain of command springs into action, involving multiple secure players who verify and approve the transaction in moments. Pulling back the curtain on this process shows just how a modern POS works to keep your money and your customer's data safe.

Think of it like dispatching a highly secure, urgent message. Your POS terminal is the messenger, sending a request for funds across a digital network. This request zips from your store to a payment processor, on to the card network (like Visa or Mastercard), and finally lands at the customer's bank. The bank quickly checks for sufficient funds and any signs of fraud before sending an "approved" or "declined" message all the way back down the line.

This entire round trip happens in about the time it takes to ask, "Would you like a receipt?" It's this blend of speed and security that makes modern commerce possible.

The Key Players in a Transaction

To really understand how a payment moves, you need to know the cast of characters. Each one has a specific job to do, ensuring every transaction is fast, accurate, and secure.

- The Merchant: That’s you! Your business is where the sale starts and where the funds ultimately end up.

- The Payment Processor: This is your financial middleman, a company that handles all the communication between your business, the card networks, and the banks.

- The Card Network: These are the big names—Visa, Mastercard, American Express. They’re the ones who set the rules for transactions and connect all the different financial institutions.

- The Issuing Bank: This is simply the customer's bank. It's the institution that issued their credit or debit card and holds their money, giving the final yes or no on the charge.

When these four players work in perfect sync, you get a seamless payment experience. This intricate digital dance is what builds customer trust and keeps your revenue flowing.

Securing the Digital Handshake

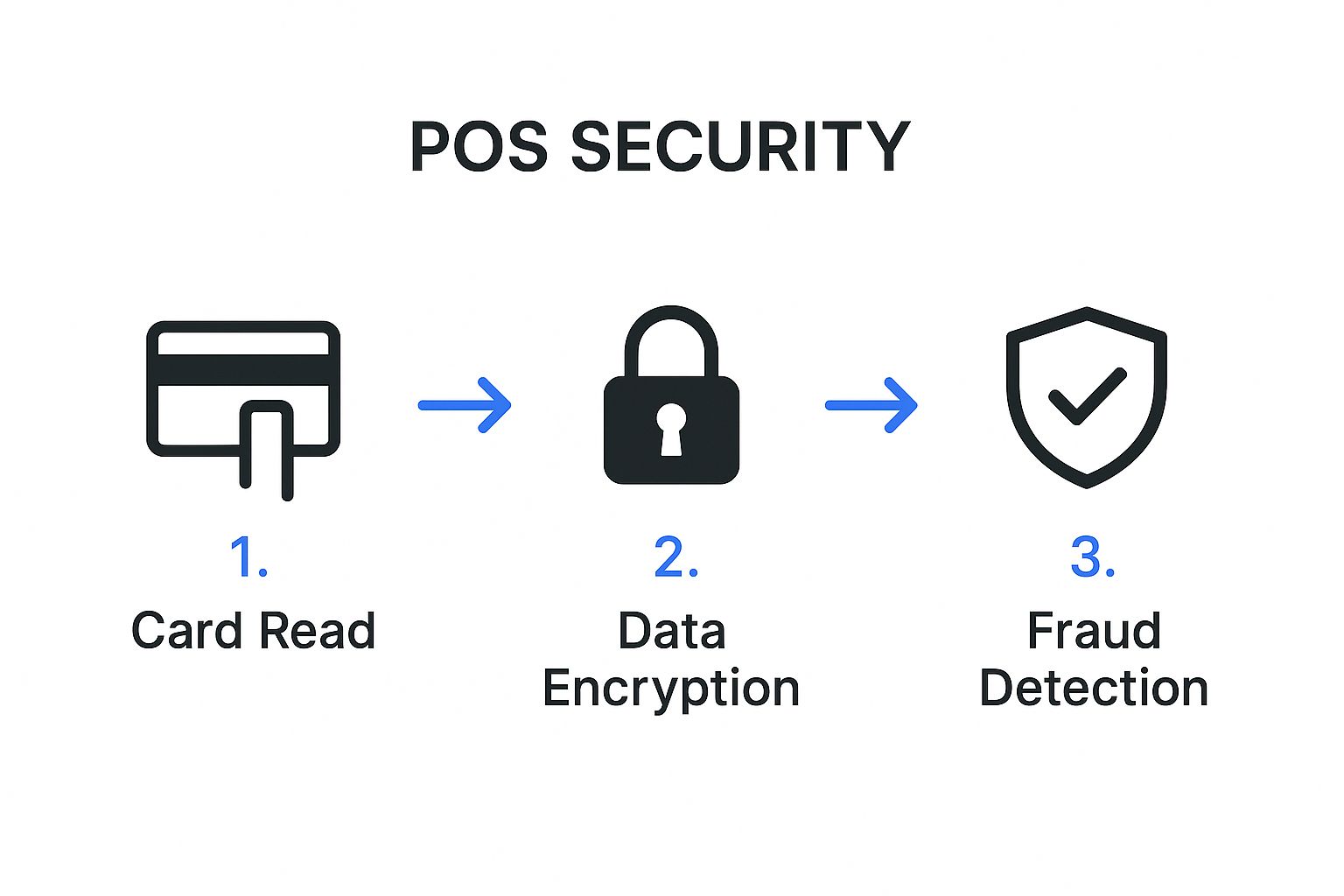

With so much sensitive data flying around, security is everything. So, how does your point of sale system protect financial information from bad actors? It all comes down to two powerful technologies working together: encryption and tokenization.

Encryption is the art of scrambling data into an unreadable code the instant a card is swiped, tapped, or inserted. Imagine putting a letter into a locked box before sending it. Even if someone intercepts the package, the contents are useless without the specific key.

Tokenization takes security a massive step further. After the initial transaction is encrypted and approved, the system replaces the customer’s actual card number with a unique, randomly generated "token." This token is all that’s stored in your system for future use, like for recurring billing or processing refunds. The real card number is never kept on your local devices, which drastically reduces your risk if a data breach ever happens.

This infographic gives you a simplified look at how these security layers work together to protect every single sale.

This three-step process—reading the card, encrypting the data, and checking for fraud—creates a powerful security shield. The approval step is a critical part of this, and you can learn more in our deep dive on payment authorization.

On-Premise vs Cloud-Based POS Systems

Not all POS systems are built the same way. The two main architectures you'll encounter are on-premise and cloud-based, and the difference is a big deal for your business operations, costs, and flexibility.

| Feature | On-Premise POS | Cloud-Based POS |

|---|---|---|

| Data Storage | All data is stored locally on-site on a server or computer. | Data is stored remotely on secure cloud servers. |

| Initial Cost | High upfront cost for hardware, software licenses, and setup. | Lower upfront cost, usually a monthly subscription fee. |

| Accessibility | Can only be accessed from the physical location of the business. | Can be accessed from anywhere with an internet connection. |

| Updates & Maintenance | Manual updates are required; you are responsible for maintenance. | Automatic updates and maintenance are handled by the provider. |

| Scalability | Difficult and expensive to scale as you grow. | Easily scalable; add terminals or locations as needed. |

Choosing between them really depends on your business needs. On-premise systems offer total control but come with heavy responsibilities, while cloud-based systems like Biyo offer incredible flexibility and are much easier to manage for the modern business owner.

The Soaring Growth of Digital Payments

The sheer efficiency and security of modern POS systems have lit a fire under the growth of digital transactions. The global POS market is on track to hit $33.41 billion, with mobile POS systems becoming especially popular—they now make up 35% of all POS transactions in retail.

Even more telling is the consumer shift toward convenience. Contactless payments now account for a whopping 54% of all global POS transactions, a significant jump from 40% just last year. This trend makes one thing clear: a fast, secure, and user-friendly payment process isn't just a nice feature anymore; it's an absolute necessity for staying competitive.

Unlocking Your POS With Powerful Integrations

A modern POS system rarely works alone. Its real value shines when it stops being just a cash register and becomes the central nervous system for your entire business. This happens through integrations—basically, digital handshakes that let your POS talk and share information with all the other software you rely on.

Think of your POS as the quarterback. On its own, it can manage the transaction at the counter. But when it's connected to your accounting software, your online store, and your marketing tools, it starts coordinating a winning game plan for the whole operation.

Creating an Automated Operational Workflow

The most immediate win from integrations? You can finally ditch all that mind-numbing manual data entry. Without them, you're stuck exporting sales data from your POS and then painstakingly typing it all into your accounting software. Or worse, manually updating your website's stock after every in-store sale. It’s tedious, and it’s a recipe for human error.

A properly integrated system puts all of that on autopilot. Every sale, refund, or new shipment of stock is instantly and automatically synced across every connected platform. This keeps your data clean, accurate, and always current. It frees you up to think about growing your business, not wrestling with spreadsheets. The value of why third-party integrations are essential for modern businesses is huge—they are the foundation of any efficient, scalable business.

At its core, integration is about creating a single source of truth for your business data. When your POS, online store, and accounting ledger all draw from the same well of information, you eliminate discrepancies and gain a clear, unified view of your business’s health.

High-Impact Connections for Your Business

While you can connect your POS to dozens of apps, a few key integrations deliver the biggest bang for your buck. These are the ones that truly transform your POS from a simple transaction tool into a business command center.

- Accounting Software (e.g., QuickBooks): This is usually the first and most important integration. It automatically pushes daily sales data, taxes, and payment info straight into your books. No more manual bookkeeping, fewer costly errors, and a much less painful tax season.

- eCommerce Platforms (e.g., Shopify, WooCommerce): If you sell both in-person and online, this is a must-have. It syncs inventory levels between your physical store and your website in real time. When something sells online, the stock count in your store’s POS is updated instantly, and vice-versa. This simple connection prevents the nightmare of selling a product you don't actually have.

- Marketing & Loyalty Tools: By linking your POS with your marketing platforms, you can use actual customer purchase history to build smart, targeted campaigns. You can automatically segment customers based on what they buy and send personalized offers that keep them coming back.

The move toward this kind of connected, cloud-based setup is happening fast. In fact, projections show that cloud POS systems are on track to grab over 72% of the retail market. Businesses need real-time data and seamless syncing across all their channels to keep up with how people shop today. By connecting your most important tools, you’re not just saving time—you're building a smarter, more responsive business where every part works together to drive growth.

Seeing It All Work: Real-World POS Scenarios

Theory is one thing, but watching a POS system operate in the real world is where it all starts to make sense. A point of sale system isn't a generic tool you just plug in; its real value comes from how it molds to the specific rhythm of a business. By walking through a few different scenarios, we can see how the hardware, software, and integrations all snap together to solve everyday problems.

Let's go behind the counter at three completely different businesses—a chic retail boutique, a bustling neighborhood café, and a fast-moving food truck—to see how their POS systems perform under pressure.

The Chic Retail Boutique: Inventory and Loyalty in Sync

Picture a clothing boutique that sells designer dresses in a dozen different sizes and colors. For this kind of shop, precise inventory management isn't just a nice-to-have feature; it’s the absolute core of the business.

When a customer decides on a size medium dress, the POS system instantly subtracts it from the stock count for that exact variant. This real-time tracking is what stops a salesperson from mistakenly selling a dress that's already gone. It's also the engine behind their customer loyalty program. The POS ties the purchase to a customer’s profile, maybe earning them points toward a future discount, while giving the owner priceless data on popular styles and repeat shoppers.

The Bustling Neighborhood Café: Speed and Customization

Now, let's head over to a busy café during the morning coffee rush. Here, the game is all about speed and getting orders right. The POS system is built for a quick-service workflow. A barista taps on a screen with a customized layout, effortlessly adding modifiers like "extra shot" or "oat milk" to a latte.

This is where the system really shines:

- Custom Orders: The POS makes it dead simple to handle complicated, multi-step orders without any errors.

- Kitchen Communication: The moment an order is confirmed, it zips over to a Kitchen Display System (KDS) in the back, telling the team precisely what to prepare.

- Fast Payments: Integrated contactless payment readers let customers just tap and go, which is crucial for keeping the line from backing up.

In this environment, the POS acts as the central nervous system, keeping the front-of-house and the kitchen perfectly in sync, even when things get chaotic.

The Dynamic Food Truck: Mobility and Offline Mode

Finally, imagine a food truck set up at a packed outdoor festival. Their needs are totally different. Space is tight, the internet connection can be unreliable, and they have to serve a long line of hungry people—fast.

For the food truck, a mobile POS on a tablet is the perfect solution. It’s compact, wireless, and built for life on the go. More importantly, it features a robust offline mode. If the internet connection drops, the POS securely stores every transaction and automatically syncs all the sales data once it's back online. This single feature is a business-saver, ensuring they never miss a sale, no matter where they set up shop. The POS processes payments quickly, tracks ingredient usage, and gives the owner a clear view of their daily earnings right from their mobile device.

Answering Your Top POS Questions

Diving into point of sale technology can feel a little overwhelming, and it's natural for questions to pop up. As you get a feel for how these systems work, you’ll probably start wondering about the practical, day-to-day stuff. We've pulled together some of the most common questions we hear to give you clear, straight-to-the-point answers.

What Is the Difference Between a POS and a Cash Register?

The easiest way to think about it is this: a cash register is a calculator with a money drawer. Its whole job is to ring up sales and hold cash. That's it. A modern POS system, on the other hand, is the central nervous system for your entire business.

Sure, it processes sales, but that's just the beginning. It also weaves in inventory management, customer relationship data, employee performance, and deep sales analytics, all in one place. A cash register is just a tool; a POS is the command center for your whole operation.

How Does a POS Work in Offline Mode?

We’ve all been there—the internet goes down right in the middle of a lunch rush. So, what happens then? A solid POS system with an offline mode is built for this exact moment.

Instead of grinding to a halt, the system keeps on ringing up sales and securely saves every transaction right there on the device. As soon as you're back online, the POS automatically syncs all that stored data to the cloud. You don't miss a single sale, and no crucial business info gets lost. It’s a must-have for keeping things running smoothly.

This offline capability is a total game-changer for businesses that can't afford any downtime—think food trucks, market stalls, or shops in areas with less-than-perfect Wi-Fi. It’s the peace of mind you need to know your business won’t stop, even when your internet does.

Are Cloud-Based POS Systems Secure?

Security is, without a doubt, a huge deal for any business owner. Reputable cloud-based POS providers are obsessive about it. Your sales data, customer information, and inventory levels are shielded by several layers of advanced security.

One of the most important is end-to-end encryption, which essentially scrambles your data as it travels from the terminal to the server, making it completely unreadable to anyone trying to intercept it. On top of that, your information is stored on highly protected remote servers that are monitored around the clock—frankly, they're often far more secure than a server sitting in a back office.

Can I Use My Own Hardware?

Often, the answer is yes. Many modern POS software solutions, like Biyo, are built to play nicely with common hardware you might already own, such as iPads, tablets, or standard desktop computers.

The key is to double-check the compatibility of peripherals like receipt printers, barcode scanners, and credit card readers. While bringing your own device can definitely cut down on upfront costs, choosing an integrated hardware bundle from your provider ensures every single piece is guaranteed to work together flawlessly from day one. It just makes the setup and any future troubleshooting that much simpler.

Ready to see how a powerful, flexible, and secure point of sale system can reshape your business? Biyo POS offers an all-in-one solution that helps you manage everything from sales and inventory to your customer relationships. Discover the Biyo POS difference and start your free trial today.