In today’s digital-first marketplace, businesses must ensure that payments are secure, fast, and convenient for customers. This is where the concept of a payment gateway API becomes critical. If you’ve ever made an online purchase, subscribed to a streaming service, or tapped your card at a POS terminal, you’ve interacted with this technology—even if you didn’t realize it. But what is a payment gateway API in detail, and why is it so important to businesses of all sizes? This guide explores its definition, functionality, benefits, and future trends, giving you a clear picture of why it has become the backbone of global commerce.

Table of Contents

- Understanding What a Payment Gateway API Is

- How a Payment Gateway API Works in Practice

- Key Benefits of Using a Payment Gateway API

- Integration Options and Developer Use Cases

- The Future of Payment Gateway APIs in Financial Technology

- About Biyo POS

- Frequently Asked Questions

Understanding What a Payment Gateway API Is

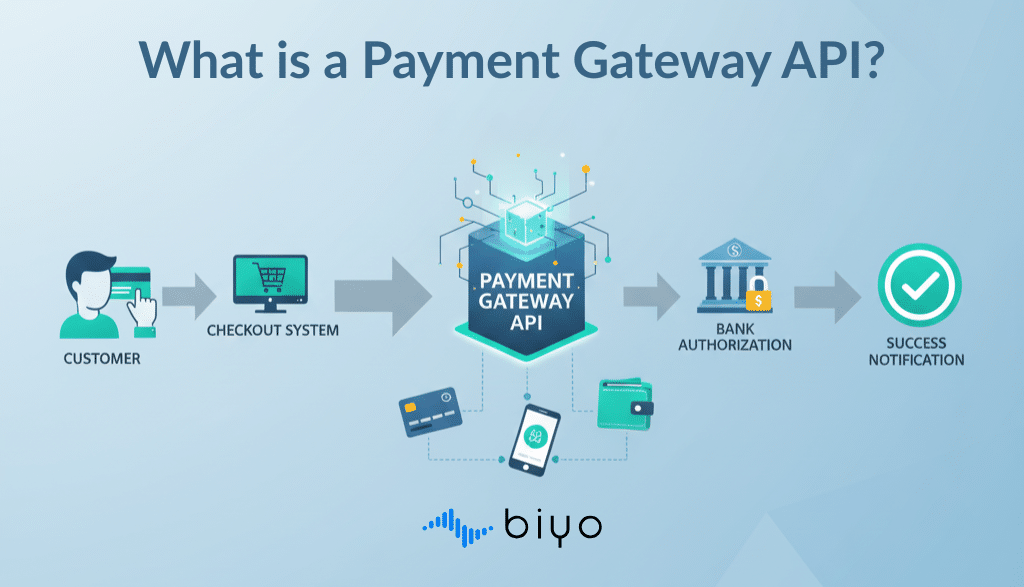

Before diving deeper into technical features, let’s start with the basics. To fully answer the question of what is a payment gateway API, think of it as the invisible digital bridge that connects your business to the financial world. It is an Application Programming Interface (API) that allows merchants, apps, and POS systems to securely communicate with banks, credit card networks, and payment processors. Without it, processing online payments or running secure transactions would be complicated and highly risky.

Definition and Core Concept

A payment gateway API functions as a translator between your business platform and financial institutions. When a customer enters their credit card details or selects a digital wallet at checkout, the API ensures this information is encrypted, validated, and sent securely to the payment processor. This process happens in seconds, but behind the scenes, it involves a sophisticated chain of authorization and verification checks. Historically, merchants had to rely on slow manual processes or clunky third-party systems to handle transactions. Today, APIs have streamlined this into seamless, automated flows that reduce human error and increase customer trust.

The core concept is that the API abstracts away the complexity of financial systems. Developers don’t need to code direct connections to multiple banks or card networks. Instead, the API provides a single point of integration that handles everything from fraud detection to tokenization. For example, when Netflix charges your subscription automatically each month, the underlying payment gateway API makes sure your card data is protected and the transaction is approved by your issuing bank. Without such automation, recurring billing would require manual effort that isn’t practical at scale.

Beyond the technical aspects, APIs also make compliance easier. Regulatory requirements like PCI DSS can be overwhelming for businesses that lack specialized security teams. However, by using a trusted API, merchants inherit many of the compliance protections built into the system. This makes adopting financial technology less intimidating for small businesses and startups, enabling them to compete with larger enterprises in global e-commerce.

Why It Matters for Modern Businesses

For businesses today, offering reliable and secure payment options isn’t just a technical necessity—it’s a competitive advantage. Customers expect instant checkout and secure transactions whether they are shopping online, paying through a mobile app, or making an in-store purchase with a credit card API. If a business lacks these capabilities, customers may abandon the transaction altogether and look for a competitor that provides a smoother experience. This makes understanding what is a payment gateway API essential for business survival.

The significance also extends to financial management. With real-time processing, merchants can track sales as they happen and manage cash flow more effectively. Consider a small restaurant that uses POS integration: every transaction is recorded automatically, eliminating the need for staff to manually log sales at the end of the day. This not only saves time but also reduces the risk of human error and theft, ensuring more accurate financial reporting. As a result, businesses can make smarter decisions based on reliable data.

Finally, a payment gateway API supports scalability. As your business grows, so does the complexity of handling different payment methods, currencies, and customer preferences. An API allows businesses to expand into international markets by adding new payment methods with minimal development effort. For example, a Turkish e-commerce store can integrate Alipay to serve Chinese customers without building a separate payment infrastructure from scratch. This adaptability makes APIs indispensable in today’s borderless economy.

Types of Payment Gateway APIs

Not every payment API is identical, and businesses often choose based on their specific needs. Direct APIs allow merchants to process payments entirely within their platform. Customers never leave the site, which enhances brand trust but also requires stricter security management. Hosted APIs, on the other hand, redirect customers to a secure third-party checkout page. While this reduces customization, it shifts the burden of compliance and fraud prevention to the provider, making it appealing for smaller merchants with limited resources.

There are also specialized APIs that focus on different channels. For example, mobile-first APIs optimize for mobile payments and digital wallets, ensuring customers can pay with one tap on their phone. Checkout APIs designed for e-commerce platforms streamline the cart-to-purchase journey by reducing the steps needed to complete a transaction. Each type of API addresses unique user needs while maintaining the common goal of secure, seamless payment processing.

More advanced APIs include built-in features like fraud scoring, multi-currency support, and recurring billing. These tools are particularly valuable for international merchants and subscription-based businesses. As financial technology evolves, APIs are increasingly offering predictive analytics and AI-driven fraud detection, which further enhances security and efficiency. Selecting the right type of payment API is therefore a strategic decision that can affect both customer satisfaction and business growth.

How a Payment Gateway API Works in Practice

Understanding what is a payment gateway API becomes clearer when we examine how it functions step by step. Every online payment involves multiple layers of authorization, verification, and settlement, all orchestrated by the API in real time. While customers see only a quick confirmation message, behind the scenes, there’s a sophisticated network of secure communications ensuring the transaction is legitimate and funds are available.

Transaction Authorization

The process begins with transaction authorization. When a customer enters their card information or selects a digital wallet, the API securely sends this data to the acquiring bank. The bank then contacts the card network, which forwards the request to the issuing bank—the customer’s bank. The issuing bank checks whether the account has sufficient funds, whether the card is active, and whether the transaction matches typical spending behavior. This entire sequence usually happens in less than three seconds, though it involves multiple systems working in sync.

Authorization is crucial for reducing fraud and errors. For example, if someone tries to use a stolen card online, the API’s fraud detection tools may notice unusual activity and block the payment. Businesses benefit because this reduces chargebacks and financial losses. Customers benefit because they are protected from unauthorized charges. Without such automated authorization processes, every online purchase would carry a much higher risk of fraud.

Another important aspect is customer experience. If the authorization process is slow or prone to errors, customers may abandon the purchase. APIs are designed to streamline this step, ensuring minimal friction and maximum reliability. For merchants, faster authorization translates to higher conversion rates and more satisfied customers.

Secure Data Transmission

Once authorization begins, secure data transmission ensures customer information is protected at every stage. Payment APIs use encryption protocols like TLS (Transport Layer Security) to scramble sensitive data, making it unreadable to hackers. Tokenization further enhances this security by replacing card details with unique digital tokens. These tokens are useless if intercepted, as they cannot be reverse-engineered into actual card numbers. This combination of encryption and tokenization forms the backbone of secure transactions in today’s digital economy.

Real-world examples highlight why this is so important. High-profile data breaches in retail and e-commerce have shown that unprotected payment systems can result in millions of stolen credit card numbers. Businesses caught in such breaches often face massive fines, reputational damage, and loss of customer trust. By relying on robust APIs, companies drastically reduce the likelihood of being targeted successfully by cybercriminals. In fact, many payment gateway providers invest millions in cybersecurity infrastructure specifically to safeguard merchant and customer data.

Secure data transmission also plays a role in compliance. Regulations like GDPR and PCI DSS require businesses to demonstrate that customer information is handled with care. APIs not only provide the technology for compliance but also offer documentation and reporting tools that help businesses pass audits. This reduces legal risk and reassures customers that their financial information is safe.

Real-Time Processing

Speed is another critical feature of payment gateway APIs. Customers expect instant payment confirmations, and any delay can lead to frustration or lost sales. Real-time processing means that once the issuing bank approves a transaction, the API communicates this back to the merchant’s system immediately. Funds may take a few days to settle, but the confirmation happens instantly, giving both customer and merchant peace of mind that the transaction went through.

Real-time processing has tangible benefits for businesses. For instance, restaurants using POS integration can instantly see which orders have been paid and which are pending. This helps staff focus on fulfilling orders without worrying about whether a card will be declined later. Similarly, e-commerce businesses benefit from reduced cart abandonment rates when customers see quick confirmations. Even in subscription services, real-time notifications allow companies to notify customers immediately if a recurring payment fails, giving them a chance to update their billing information without service disruption.

From a financial perspective, real-time processing improves cash flow visibility. Merchants can track revenue as it happens and make informed decisions about inventory, staffing, and marketing. In industries with thin margins, this level of visibility can make the difference between profit and loss. For this reason, APIs that deliver real-time updates are considered superior solutions in the world of financial technology.

Key Benefits of Using a Payment Gateway API

Now that we’ve covered how it works, let’s turn to why businesses invest in these systems. The advantages of using a payment gateway API range from improved customer experiences to increased security and revenue growth. These benefits explain why APIs are central to financial technology strategies across industries.

Seamless Payments Across Platforms

One of the main benefits is seamless payment processing across different platforms. Today’s customers want to pay their way—whether that’s with credit cards, debit cards, mobile payments, or digital wallets. Payment APIs allow businesses to support all these options through a single integration. For example, an online retailer can offer checkout through Visa, Mastercard, Apple Pay, and PayPal without building separate connections for each provider. This convenience attracts more customers and reduces abandoned carts during checkout.

For in-store transactions, APIs enhance the functionality of POS systems. A grocery store using an integrated POS can process card swipes, tap-to-pay transactions, and loyalty points all in one place. This seamless experience shortens checkout lines and leaves customers with a positive impression. Over time, businesses that consistently offer frictionless payments build stronger loyalty and repeat business.

Global expansion also benefits from seamless payment integration. A clothing store in Europe, for instance, can accept payments from Asian digital wallets or American credit cards without building custom solutions. By handling multi-currency transactions and regional preferences, APIs open doors to international markets that would otherwise be difficult to reach.

Improved Security and Fraud Prevention

Security is a top priority for any business handling sensitive financial data. Payment APIs deliver advanced fraud prevention tools, such as machine learning algorithms that detect suspicious activity in real time. These systems analyze thousands of variables, such as spending patterns and geolocation, to identify unusual behavior. If an anomaly is detected, the API can automatically request additional authentication or block the transaction. This proactive approach helps businesses minimize chargebacks and losses from fraudulent activity.

Customers benefit as well because their data is better protected. Tokenization ensures that their card details are never stored in raw form, while encryption shields information in transit. For example, if a hacker tries to intercept a payment between a customer and an online store, they will only capture meaningless tokens. This level of protection builds customer trust, which is essential for encouraging repeat purchases and long-term loyalty.

Compliance with regulatory standards is another benefit. APIs are designed to help businesses meet the requirements of PCI DSS, PSD2, and GDPR. By outsourcing much of the heavy lifting to gateway providers, merchants reduce their legal exposure and focus on serving customers. The result is a safer ecosystem for everyone involved in the payment process.

Support for Recurring Billing

Subscription-based business models have exploded in recent years, from Netflix to gym memberships. Payment APIs make recurring billing possible by automating repeat charges securely. Once a customer opts into a subscription, the API ensures their payment method is billed at regular intervals without the need for manual intervention. This reliability is essential for businesses that depend on predictable revenue streams.

Recurring billing benefits customers too. They no longer need to remember to make monthly payments or re-enter their card details. Instead, the process happens automatically, with clear receipts and notifications provided by the merchant. For example, a SaaS platform can notify a user when their card is charged each month, reinforcing transparency and trust in the relationship.

From a business perspective, recurring billing reduces churn and increases customer lifetime value. By ensuring payments happen consistently and without friction, businesses can focus on delivering value rather than chasing overdue accounts. APIs that support recurring billing also provide flexibility, such as pausing, upgrading, or downgrading subscriptions with minimal effort, which improves overall customer satisfaction.

Integration Options and Developer Use Cases

A key part of what is a payment gateway API involves how developers and businesses actually implement it. APIs are built to be flexible and customizable, enabling them to adapt to various industries and use cases. Whether you’re a retailer, an e-commerce brand, or a SaaS platform, integration options are available that can streamline your payment workflows.

POS Integration for Retail

In physical retail, POS integration is a game-changer. By linking POS terminals directly to payment gateway APIs, merchants can process payments instantly without relying on outdated manual systems. This reduces waiting times at checkout and enhances customer satisfaction. For instance, a busy coffee shop can process hundreds of payments per hour thanks to efficient POS integration with real-time updates.

POS integration also brings back-end benefits like inventory synchronization. Each sale updates stock levels automatically, reducing the chance of overselling or stockouts. In multi-location businesses, APIs allow central oversight of sales and inventory data, making it easier for managers to track performance across branches. This creates a unified system where payment data and operational data are seamlessly linked.

An additional advantage is fraud prevention at the point of sale. APIs can flag suspicious in-store transactions, such as unusually high-value purchases, and require additional verification. This adds a layer of protection without slowing down regular transactions, creating a balance between security and convenience for retail operations.

E-Commerce and Checkout Systems

For online businesses, checkout is often the most critical part of the customer journey. Payment gateway APIs optimize this stage by making transactions fast, intuitive, and secure. A clunky checkout system with too many steps can drive customers away. By integrating APIs, businesses can streamline the process, offer one-click payments, and display real-time confirmation messages that boost confidence in the purchase.

Developers also benefit from customization options. They can design checkout systems that match the look and feel of the brand, reinforcing trust. APIs also allow integration of fraud filters, multi-currency support, and language localization, making it easier to serve global customers. This adaptability is why checkout APIs are considered must-have tools for e-commerce brands expanding internationally.

From a strategic standpoint, checkout APIs also enable upselling and cross-selling. For example, a streaming platform might offer a discounted add-on service during checkout, or an online store might recommend complementary products. By embedding these features into the payment process, businesses can increase their average order value and boost profitability.

Developer-Friendly Features

Payment gateway APIs are designed with developers in mind. They typically come with detailed documentation, SDKs, and sandbox environments that make testing and deployment easier. Developers can simulate real-world scenarios, experiment with different payment methods, and ensure the system works smoothly before going live. This minimizes risk and shortens the time to market for new features.

Another developer-friendly feature is webhook notifications. These allow businesses to receive real-time updates when payments succeed, fail, or require action. For instance, if a customer’s recurring payment fails due to an expired card, the API can trigger a webhook to notify both the customer and the merchant instantly. This reduces downtime and ensures proactive customer support.

Overall, these features empower developers to build tailored solutions without reinventing the wheel. Whether you’re creating a subscription billing system, a donation platform, or a mobile wallet app, APIs provide the tools needed to deliver reliable, secure, and innovative payment experiences.

The Future of Payment Gateway APIs in Financial Technology

The world of financial technology is evolving rapidly, and payment gateway APIs are at the center of this transformation. They are no longer just about connecting banks to merchants; they are shaping new forms of commerce, improving security, and expanding access to global markets. Understanding where this technology is heading can help businesses prepare for upcoming opportunities and challenges.

Integration with Digital Wallets and Mobile Payments

As mobile adoption continues to rise, digital wallets are becoming a dominant form of payment. APIs will increasingly integrate with wallets like Apple Pay, Google Wallet, and Samsung Pay, giving customers more options to pay with just a tap. In many Asian markets, mobile-first payments already account for the majority of transactions, and Western markets are quickly following this trend.

For businesses, this shift means embracing APIs that support contactless payments. Restaurants, retailers, and service providers that fail to adopt mobile payment solutions may lose customers to competitors who offer faster and more convenient checkout options. APIs make this transition smoother by handling the technical complexities of wallet integration.

Looking forward, we can expect APIs to expand beyond wallets into biometric payments, such as fingerprint or facial recognition systems. This evolution will make transactions not only faster but also more secure, further boosting customer trust and satisfaction.

Artificial Intelligence and Fraud Detection

Fraud remains a major threat in payment processing, but artificial intelligence is making it easier to combat. Future APIs will embed AI algorithms that analyze millions of data points per second to detect and block fraudulent activity. Unlike traditional rule-based systems, AI can adapt to new fraud tactics dynamically, providing stronger protection for both merchants and customers.

AI also enhances customer experience by personalizing payment recommendations. For example, an API could suggest the fastest or cheapest payment method based on a customer’s past behavior. This not only speeds up checkout but also makes payments feel tailored and user-friendly. Businesses that leverage AI-powered APIs will likely see higher satisfaction and loyalty rates.

Moreover, AI can reduce operational costs by minimizing the need for manual fraud reviews. This allows companies to reallocate resources toward growth initiatives while still maintaining robust fraud defenses. The result is a safer, more efficient payment ecosystem that benefits all stakeholders.

Cross-Border Payment Innovations

Global commerce is expanding rapidly, and cross-border payments are essential for businesses looking to tap into international markets. Payment APIs will increasingly support multi-currency transactions, language localization, and compliance with regional regulations. This ensures that a merchant in Europe can seamlessly sell to customers in Asia, North America, or Africa without needing to manage separate systems for each region.

For example, an online retailer in Turkey could use a payment API to accept USD, EUR, or GBP while still receiving payouts in Turkish lira. The API handles currency conversion, compliance checks, and settlement logistics automatically. This reduces friction for both the business and the customer, creating a smoother global shopping experience.

Cross-border APIs are also driving innovations in real-time international payments, which traditionally take days to clear. With modern APIs, funds can move across borders in hours or even minutes. This trend will make international trade more accessible to small and medium businesses, not just multinational corporations.

About Biyo POS

Biyo POS is a modern payment and POS platform built for businesses that want seamless, secure, and affordable transaction solutions. Designed for restaurants, cafés, grocery stores, and retail shops, Biyo POS provides free POS hardware, AI-powered voice ordering, offline functionality, and advanced fraud prevention. Its powerful API integration makes it easy for merchants to accept credit cards, digital wallets, and mobile payments without hidden fees. Businesses can manage multiple locations from a single dashboard, streamline inventory, and save thousands in processing costs. To get started, new merchants can sign up here and unlock the benefits of financial technology designed for growth.

Frequently Asked Questions

What is a payment gateway API in simple terms?

A payment gateway API is a tool that connects your business system—whether it’s a website, app, or POS—with banks and processors. It makes online and in-store payments fast, secure, and reliable by handling all the behind-the-scenes communication automatically.

Is a payment gateway API safe to use?

Yes, payment gateway APIs use security methods like encryption and tokenization to protect sensitive data. They also comply with strict industry standards such as PCI DSS and GDPR, making them one of the safest ways to process online payments and prevent fraud.

How does a payment gateway API help small businesses?

Small businesses gain by offering multiple payment options, faster checkout, and better security without heavy development costs. With a gateway API, they can easily accept credit cards, mobile payments, and digital wallets, while improving cash flow and reducing operational risks.