Ready to take credit card payments right from your phone? It's easier than you think. All you really need is your smartphone, a payment processing app, and sometimes a small card reader. This simple setup turns your phone into a mobile point-of-sale (POS) system, letting you handle transactions no matter where you are.

It’s a game-changer for businesses that don't operate from a fixed location.

Your Guide to Mobile Payments

Turning your phone into a payment terminal isn't just for big-box retailers anymore. Now, freelancers, market vendors, and small shop owners can process payments instantly, meaning you never have to turn away a customer who isn't carrying cash.

Think about it: a food truck owner at a packed festival or a plumber finishing up a house call can close the deal on the spot. This flexibility comes from modern payment apps and compact, affordable hardware that deliver professional features without the clunky, expensive cash registers of the past.

The Modern Way to Do Business

So, why is this so popular now? For a small or growing business, the advantages are huge.

- Total Portability: Your entire payment setup fits right in your pocket. You can finalize a sale at a trade show, a client's office, or a pop-up shop just as easily as you would in a store.

- Low Startup Costs: The initial investment is tiny. Most payment apps are free to download, and many processors will send you a card reader for free or for a very low cost.

- More Sales: Let's be honest, people spend more when they can use a card. By offering that convenience, you get rid of a huge obstacle and capture sales you might have otherwise lost.

The bottom line is that you can meet your customers wherever they are. In a world where convenience rules, simply being able to say, "Yep, I take cards" is a massive advantage for growing your business and keeping customers happy.

To get started, it's helpful to have a clear picture of what you'll need.

Mobile Payment Setup Checklist

Here’s a quick rundown of the essential components for accepting mobile payments.

| Component | What You Need | Key Consideration |

|---|---|---|

| Hardware | A compatible smartphone or tablet (iOS or Android). | Ensure your device's operating system is up-to-date to run the latest app version. |

| Software | A mobile payment processing app. | Compare transaction fees, features, and payout speeds. |

| Card Reader | A small, portable reader that connects via Bluetooth or headphone jack. | Decide if you need a simple magstripe reader or one that accepts chip and tap-to-pay. |

| Internet | A reliable cellular data or Wi-Fi connection. | Unstable connections can lead to failed transactions, so always have a backup plan. |

With these pieces in place, you're ready to go. The goal here is to make the technology feel less intimidating and show you just how fast you can get up and running. Getting a handle on the basics of mobile payment technology is your first step toward seizing every sale that comes your way.

Choosing the Right Payment App and Card Reader

Before you can start taking payments on your phone, you have to pick the right tools for the job. This is easily the most critical part of the process. What works for a freelance photographer won't be the best fit for a food truck, so it's not a one-size-fits-all decision.

You've probably heard of the big players in the mobile payment space. They all offer great, competitive options, but they're built differently. The trick is to dig into their fee structures and features to find the one that matches how you actually do business.

Think about it from the perspective of a vendor at a weekend craft fair. Your priorities are speed, reliability, and keeping costs down. You might find one company offers a free basic reader, which sounds great, but then you notice they charge a much higher fee for manually keyed-in transactions. If you take a lot of orders over the phone, that "free" reader could end up costing you more in the long run.

Comparing Your Options

As you start comparing apps, you really need to zero in on a few key areas:

- Transaction Fees: Most will charge a percentage of the sale plus a small flat fee. The important thing to notice is that the rate for tapped or chip cards is almost always lower than for card numbers you type in yourself. Why? Because a card that's physically present is more secure.

- Hardware Costs: Many providers will get you started with a simple magstripe or tap-to-pay reader for free or for a very low cost. If you want something more advanced that handles chip cards and all types of contactless payments, you're probably looking at a cost between $50 and $100. For a deeper dive, our guide on what to look for in a mobile card reader breaks it all down.

- Extra Features: Do you just need to take a payment, or do you need more? Some apps come with built-in inventory tracking, tools for managing employees, or invoicing features right out of the box. Others offer these as paid upgrades.

The goal is to align the service's pricing and features with your business model. If you process a lot of sales, low transaction fees are your top priority. But if you run a service-based business, powerful invoicing tools might be worth a slightly higher fee.

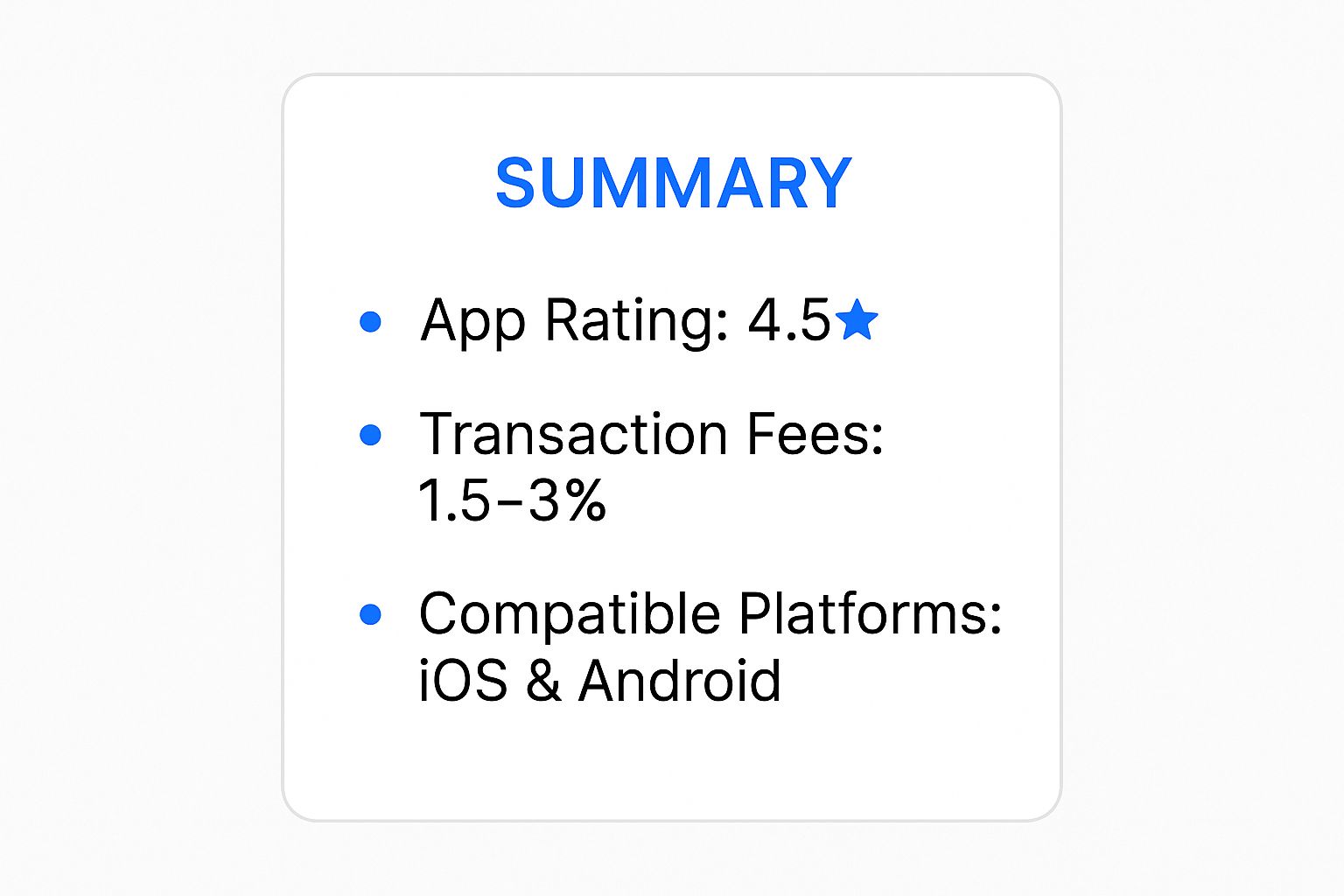

Here's a quick look at what you can generally expect from the top mobile payment apps on the market today.

The takeaway here is that high-quality, reliable apps are well within reach, with transaction fees that won't break the bank for most small businesses.

The Growing Demand for Card Payments

Jumping into mobile payments isn't just about convenience for you; it's about meeting your customers where they are. Consumer behavior has shifted dramatically. Back in 2016, credit cards accounted for just 18% of all consumer payments in the U.S. By 2024, that number has shot up to 35%.

This explosion in card usage is largely thanks to how easy contactless payments and mobile wallets have made things. People expect to be able to tap their card or phone, and businesses need to be ready. Picking the right app and reader now puts you in the perfect position to meet that demand.

Getting Your Account Ready for Business

Alright, you've picked your payment app. The good news is you're just a few minutes away from actually taking credit card payments on your phone. The setup process is usually pretty painless, designed to get you from a fresh download to your first sale without a lot of hassle.

First things first, head to the Apple App Store or Google Play Store and download your app. When you open it, you'll be walked through creating an account. This is where you'll plug in the basics about your business—name, what you do, and a rough estimate of your annual sales.

Connecting Your Bank to Get Paid

Now for the most important step: telling the app where to send your money. You’ll need to link your bank account by entering your routing and account numbers. Don't worry, this is all done through a secure, encrypted connection.

To make sure everything is correct, most processors will send a tiny test deposit to your account. You'll see this pop up in about 1-2 business days.

This little verification step is a big deal for security. It’s the system's way of double-checking that your sales revenue is heading to the right place, protecting you from typos and fraud.

Once your bank is linked up, it's time to tweak the settings to your liking. This is where you can really make the app work for you.

- Tackle Sales Tax: You can set up your local tax rates right in the app. It’ll automatically calculate and add the correct tax to every sale, which saves a ton of manual math later.

- Brand Your Receipts: Customize your digital receipts with your logo and contact info. It’s a small detail that makes your business look sharp and professional.

- Set Up Tipping: If you accept tips, you can enable preset options like 15%, 20%, or 25%. This makes it super simple for happy customers to add a little extra.

Seeing It All Come Together

Let’s put this into a real-world context. Imagine you're a freelance photographer wrapping up a $350 family portrait session in the park. Instead of dealing with invoices and late payments, you just pull out your phone.

You open the app, key in $350, and watch as it automatically adds the sales tax you already configured. You hand your phone to the client, they tap their card or use their phone's wallet, and boom—payment approved in seconds. You can then immediately email them a branded receipt, closing the loop on the entire job right then and there.

As you set up your account to take payments, integrating with efficient booking systems can significantly boost your revenue. For further insights, learn about modern appointment booking systems.

Fees, Security, and Best Practices You Can't Ignore

When you start accepting credit cards on your phone, you're juggling two things that can define your success: the fees you pay and the security you provide. Getting a handle on both isn't just a good idea—it's essential for protecting your bottom line and your customers' trust.

Let's break down the fees. Every time a customer pays, a small slice of that sale goes to your payment processor. These fees aren't arbitrary; they’re all about risk.

For instance, a contactless tap or a chip card payment is considered highly secure because the physical card is right there. This means you'll pay a lower fee. On the other hand, if you have to manually key in the card number, the risk of fraud goes up, and so does your processing fee.

Think of transaction fees as the cost of doing business safely and conveniently. They might seem small, but they add up quickly. The trick is to find a processor with a fee structure that makes sense for how your customers usually pay, so you can keep more of your hard-earned money.

How Security Works (and Why It Matters)

This is where a good payment app really earns its keep. The best ones manage all the complex security measures behind the scenes so you can focus on your business. Here’s what’s going on under the hood:

- End-to-End Encryption: From the second the card data is captured, it’s scrambled into unreadable code until it safely reaches the payment processor. This makes the information useless to any would-be thieves.

- PCI Compliance: This is the gold standard for securely handling credit card information. Reputable apps are already PCI compliant, which lifts a huge regulatory weight off your shoulders. To dive deeper, check out our guide on the Payment Card Industry Data Security Standard (PCI DSS).

Beyond the app's built-in features, you have a role to play, too. Knowing how to prevent credit card fraud is one of the most important skills you can develop. Simple steps, like always asking for the CVV code and matching billing information, can save you a world of headaches and costly chargebacks down the line.

The shift to mobile is undeniable. The global payments market is skyrocketing toward a projected $18.6 trillion value, largely because digital wallets have become so common. Here in North America, a staggering 89% of consumers use a digital wallet every month, proving that if you’re not accepting mobile payments, you’re missing out.

Embrace the Speed of Digital Wallets and Contactless Payments

Let's talk about the quickest way to get paid: digital wallets. Think Apple Pay and Google Pay. Customers love them because they can complete a purchase with a simple tap of their phone. This "tap-and-go" method creates a seamless checkout that makes everyone's life easier.

This all works thanks to a technology called Near Field Communication (NFC), a short-range wireless signal. The best part? Most modern smartphones already have NFC built right in, so you can start accepting these payments without buying any extra hardware. It’s a simple way to show your customers you’re keeping up with the times.

The Tap-to-Pay Takeover

Digital wallets have become incredibly popular for one simple reason: they remove friction. Customers no longer have to dig through their purse or wallet for a physical card. Imagine running a busy coffee shop or a food truck—this speed translates directly into shorter lines and happier, more impressed customers.

This isn't just a local trend; it's a global shift. Contactless payments are quickly becoming the norm. In fact, Apple Pay alone accounted for roughly 12% of all online card transactions in 2023. That level of adoption shows just how much people trust mobile payment tech, which means it’s something your business really can’t afford to ignore. You can dig into more credit card trends to see the full picture.

Better Security Gives Everyone Peace of Mind

Beyond the sheer convenience, digital wallets bring a major security boost to the table. When a customer uses Apple Pay or Google Pay, their actual credit card number is never transmitted during the sale. Instead, the system generates a unique, one-time-use code for that specific transaction. This process is known as tokenization.

What this means for you and your customers is that even if transaction data were somehow intercepted, it would be completely useless to a fraudster. Offering this level of security is a fantastic way to build trust and give customers the confidence to buy from you again and again.

Common Questions About Phone Payments

Diving into the world of mobile payments can bring up a few questions. I get it—you want to make sure you're doing things right. Let's tackle some of the most common things business owners ask when they start taking credit card payments on their phones.

How Secure Are Phone Transactions, Really?

This is probably the number one question I hear, and it's a good one. The short answer is: yes, it’s incredibly secure.

Modern payment apps don't just wing it; they use serious security tech like end-to-end encryption and tokenization. What this means in plain English is that your customer's actual card number is never stored on your phone or in the app itself. The data is scrambled and replaced with a one-time token, making it just as safe as any high-end terminal you’d find in a major retail store.

Just be sure to stick with well-known, reputable payment providers and always process transactions on a secure Wi-Fi network or cellular connection, not public Wi-Fi.

When Does the Money Actually Hit My Bank Account?

Getting paid quickly is obviously a huge deal. The good news is, the days of waiting weeks for credit card batches to clear are long gone.

Most mobile payment processors get the money into your linked bank account by the next business day. Some, for a small fee, even offer instant transfers. This can be a real game-changer if you need immediate access to your funds to buy more inventory or cover an unexpected expense.

It's worth remembering that accepting cards on the spot is more than just a convenience—it's what customers now expect. When someone knows they can easily pay with their card, they’re not only more likely to buy, but they often spend more, too.

Ultimately, this simple setup does more than just get you paid; it streamlines your cash flow and makes for a much smoother customer experience.

Ready to turn your phone into a complete point-of-sale? Biyo POS gives you everything you need to manage sales, inventory, and payments in one simple app. Find out more and start a free trial with Biyo POS.